Drake Accounting®: What options do I have for payables?

To set up general payables settings and assign specific account numbers from the Chart of Accounts to payables features, go to Payables > Options.

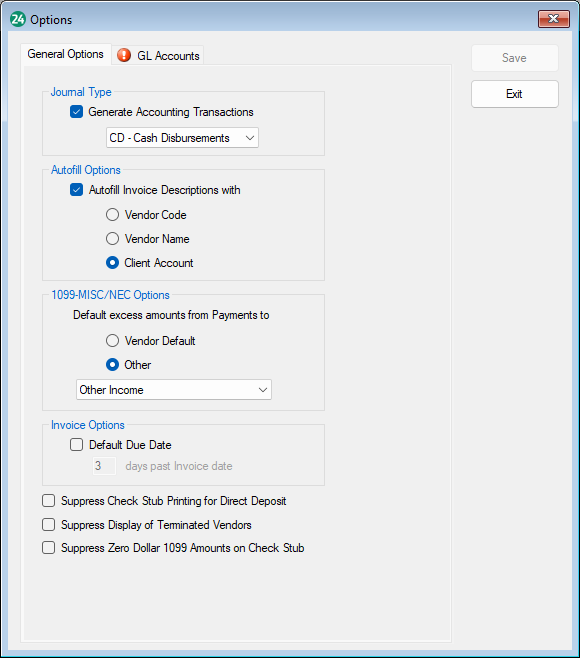

- Under the General Options tab, select Generate Accounting Transactions if you want the payables transactions to automatically post to the transactions journal and the Chart of Accounts when you click Post Transactions.

- Once Generate Accounting Transactions has been selected, the journal type becomes available, and you have the option to select:

- GJ – General Journal.

- CD – Cash Disbursements.

- CR – Cash Receipts.

- PAY – Payroll

- BUD – Budget

- AJ – Adjusted Journal

- Select Autofill Invoice Description with if you want to auto-fill your payables invoice description with the Vendor Code, Vendor Name, or the Client Account.

- The invoice description will flow to the Journal and create the description for the Journal transactions.

- Default excess amounts from Journal to is used to specify where non-defaulted payments should be included on the vendor's 1099-MISC.

- Vendor Default - Non-defaulted payments will flow to the default set up per vendor in the Vendor Setup. For example, if the Default drop list (under 1099 Options) in Vendor Setup is set to Medical and Healthcare, this is where the payments will flow to on the 1099-MISC.

- Other - This is the global option to select where payments flow to on the 1099-MISC for all vendors, unless a specific Default is selected in a vendor's setup. Use the drop-down menu to select the appropriate option.

- Invoice Options works for new invoices created after making this selection (i.e., this will not change the date on reopened invoices). Select the Default Due Date and enter the number of days past the Invoice date to have a due date flow to an invoice. For example, if a new invoice is dated for 1/15/2024 and you enter 4 for days past Invoice date, the due date on the invoice will be 1/19/2024.

- Select Suppress Check Stub Printing for Direct Deposit if you do not want to print check stubs for direct deposit payables transactions.

- Select Suppress Display of Terminated Vendors if you do not want to see terminated vendors under Payables > Vendor Setup.

- Select Suppress Zero Dollar 1099 Amounts on Check Stub if you want only the amount for the applicable 1099 amount to show on the check stub.

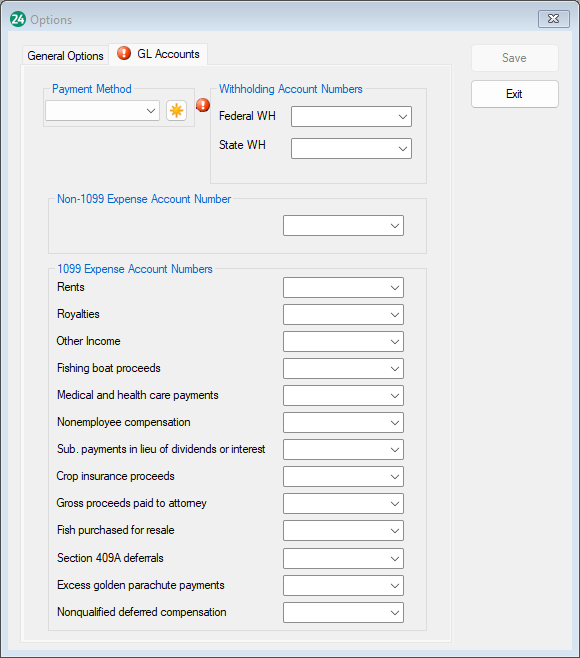

- If you use Chart of Accounts and would like to use it in Payables, go to the GL Account Numbers tab. This tab allows you to specify which accounts you would like to use for each section.

Once this is set, it will become default accounts for the other screens within the Payables module. You can, however, override the default accounts with another account in the GL Accounts tab in the Vendor Setup.

Always click Save once you are finished setting up your options.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!