Drake Accounting®: How do I set up New Jersey Family Leave Insurance?

Summary of NJ FLI setup:

- Confirm the client’s state is NJ.

- Set the appropriate NJ FLI rates.

- Set up the NJ FLI as a deduction.

- Assign the NJ deduction to employees.

Detailed setup steps:

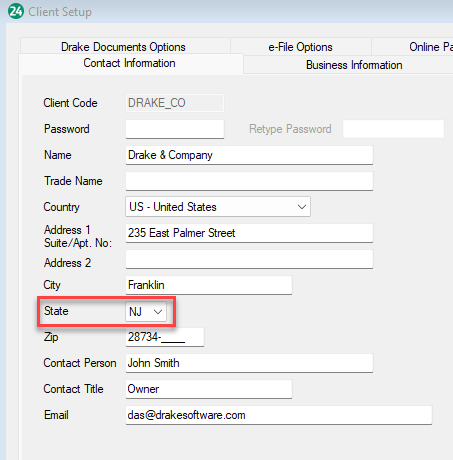

- Confirm that the client’s state is NJ in Client > Edit > Contact Information.

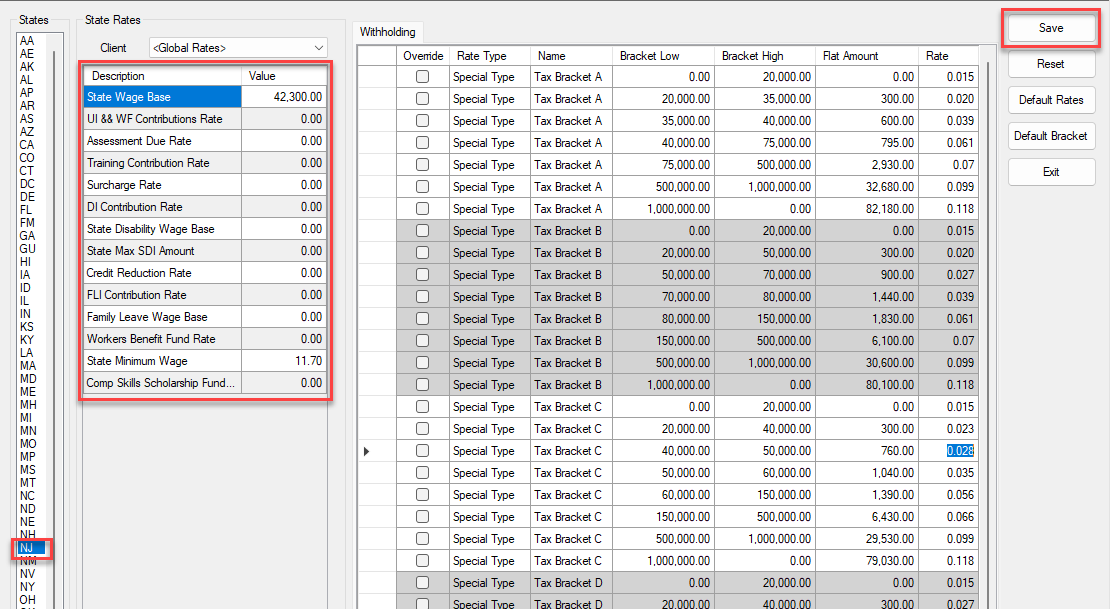

- Set the appropriate state rates and limits for NJ on the State Setup under Firm > Rates & Withholding Setup.

- Set, confirm, or correct the NJ information.

- Here is an example of NJ state rates:

- If you have not previously entered this information, these fields display the 0.00 default setting.

- Once you have entered the correct information for NJ, click Save.

Set up the Family Leave Insurance

Set up the Family Leave Insurance deduction at Employees > Deductions & Benefits. Click on the Deductions tab and click New to add the FLI as a deduction.

- Name – Enter the name of the deduction (such as "NJ FLI").

- Account – Necessary if you are using the Bookkeeping function.

- Amount – Enter the same percentage as in the FLI Contribution Rate field on the Firm> Rates & Withholding Setup > State Setup.

- Ceiling – Enter the max amount for the deduction.

- Percent – Choose Percent in the Based on droplist.

- As appropriate, make selections in the Deduct After Tax and Exempt From sections.

- Taxable settings must be determined by the preparer and the employer.

- Withholding Code – Choose Family Leave Insurance Plan (Gross) or Family Leave Insurance Plan (FICA) in the droplist.

%20(DAS)1.jpg)

- Click Save to save changes.

- Exit the screen if you are done adding deductions.

Assigning NJ FLI to Employees

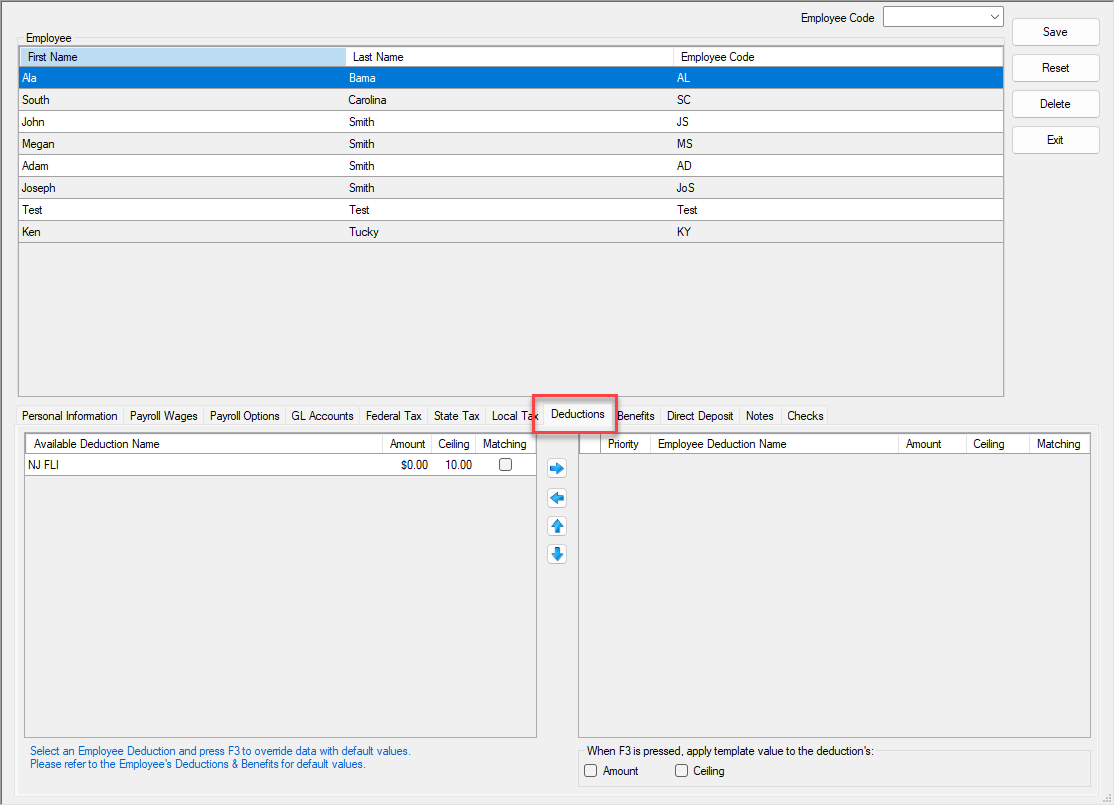

- Assign the NJ FLI deduction to employees on the Employees > Employee Setup > Deductions tab.

- Complete this step for each employee.

- Double-click or select the employee and click the Deductions tab. You will see the available deductions listed on the left column:

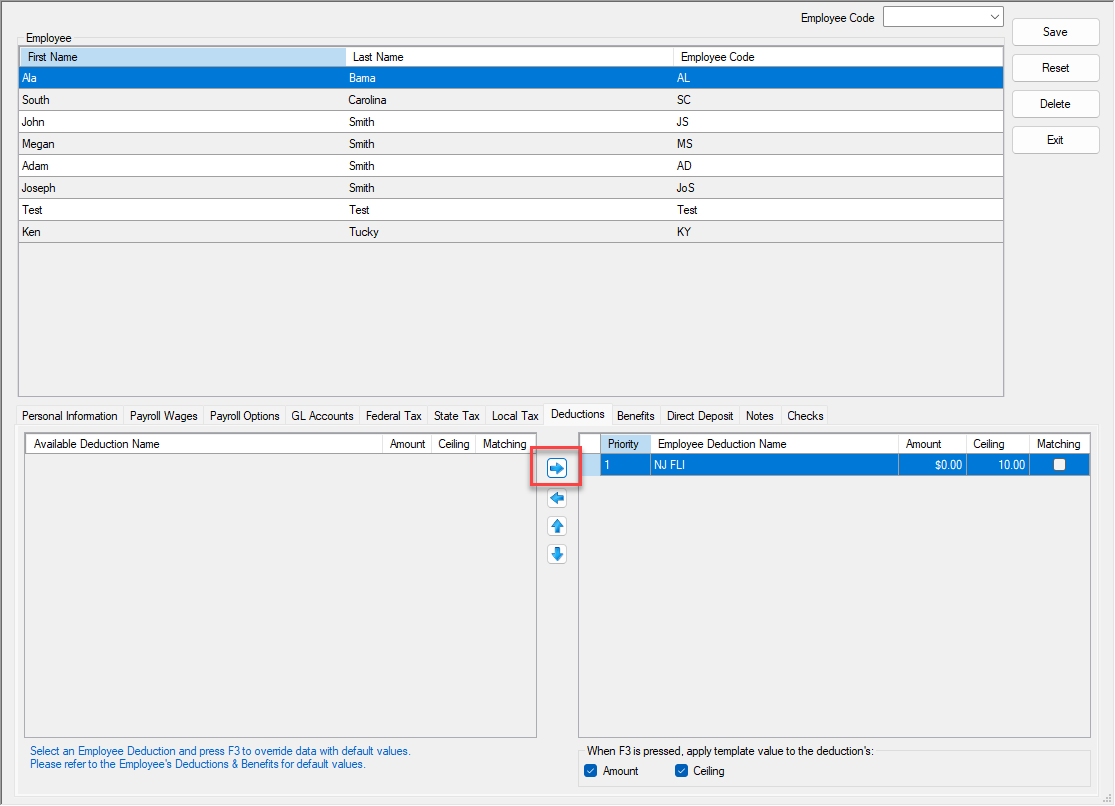

- Click the NJ FLI line item and click the blue arrow button (

) to bring over the default deduction for the employee.

) to bring over the default deduction for the employee.

- Verify the information is correct or edit as needed.

- Click Save.

NJ FLI on Tax Liability Report

Once you click Save and enter payroll for the employees, the NJ FLI will show on the tax liability report.

Go to Employees > Reports (Crystal Reports® in DAS21 and prior) > Tax Liability Report.

5.jpg)

The Family Leave Insurance for New Jersey will show under the State Taxes for New Jersey.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!