Click on an item in the list to navigate to the details of the enhancement.

- User Setup & Security Features

- Multi-Location (aka Multi-State) Payroll

- Ability to add Global Deductions & Benefits

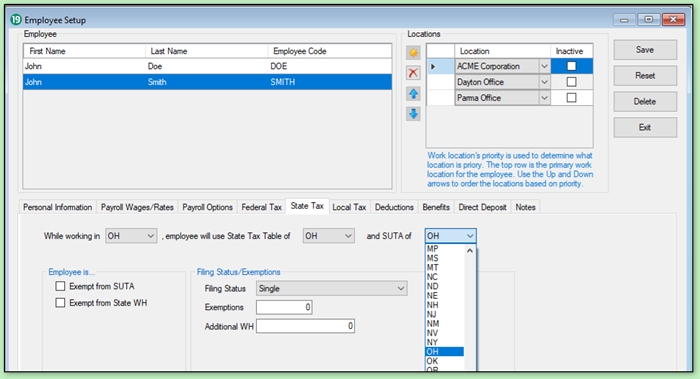

- Multi-Location Payroll — Employee Setup

- Accurate Calculations

- Employee Setup - State Tax & SUTA Selection

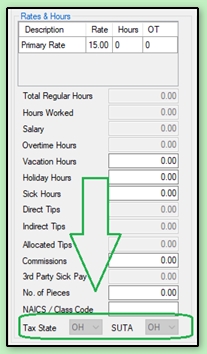

- Payroll Screen - State Tax & SUTA Selection

- Graphical & Drill-Down Crystal Reports

1. User Setup & Security Features

- Required user logins, per IRS specification for payroll products

- User levels & tiered user permission management

- Security questions for easier password recovery

- Ability to restrict access to specific screens and modules

- Adjustable password reset frequency

- Per user customization of features, including:

- Icon-based desktop view

- MICR printer

- Customizable lock screen image

- Journal screen options now configurable per user

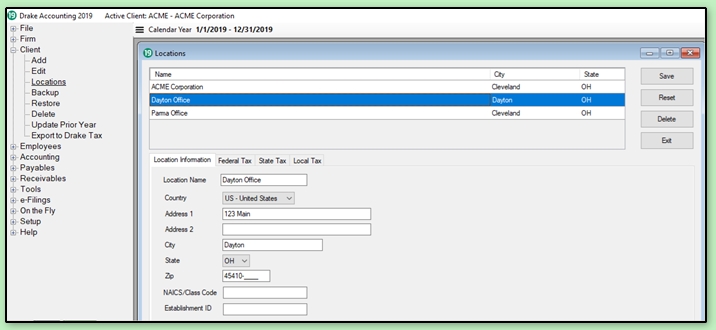

2. Multi-Location (aka Multi-State) Payroll

Drake Accounting® 2019 is now able to be customized for multiple locations when generating payroll. This means payroll for employees who work in multiple locations, even across state lines, will correctly calculate state withholding, local taxes, and location specific benefits & deductions. Employee payroll information then flows correctly to the appropriate federal and state wage & tax forms, as well as the various payroll-related financial reports — which are now broken down by location / state where appropriate.

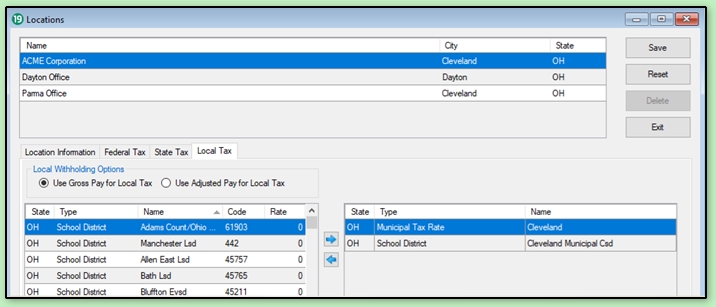

To illustrate the capabilities of Drake Accounting® 2019, consider a company (ACME Corporation) based in Cleveland, Ohio with employees who work in Cleveland, Parma, and Dayton. Ohio typically has a Municipal and School Local Tax applicable to employees who work at any location in the state. Drake Accounting® 2019 will now correctly calculate in this example without additional manual adjustments. This streamlines data entry for multi-state and multi location scenarios.

- Setting Up Multiple Payroll Locations

To set up multiple locations for the client, go to Client > Locations. Enter the location name and make any necessary selections. Then click Save. After entering all locations for the client, exit the screen.

- Location Customization for Employee Defaults

Locations can be customized with Federal, State, and Local Tax defaults that are inherited by each employee added to a customized location. For instance, a Cleveland, Ohio office can be customized to automatically add the appropriate Municipal and School District Tax — saving data entry for each employee.

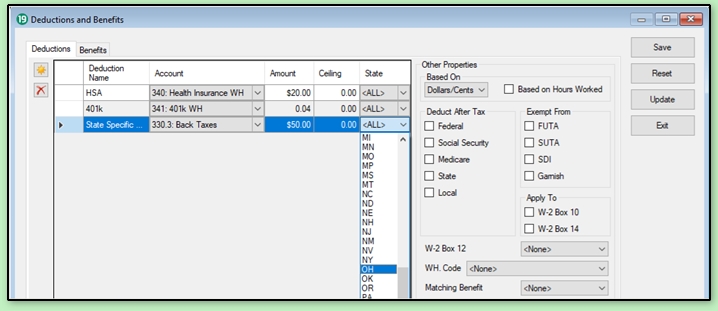

3. Ability to Add Global Deductions & Benefits

Often, you will want a specific benefit or deduction to apply for an employee across all locations. A 401k or HSA deduction, for instance, should typically apply regardless of where an employee works. The State drop-down list can be used to configure deductions or benefits that should be limited to a specific state. Leave the selection as <ALL> to allow the deduction to be figured for all states in which an employee receives payroll.

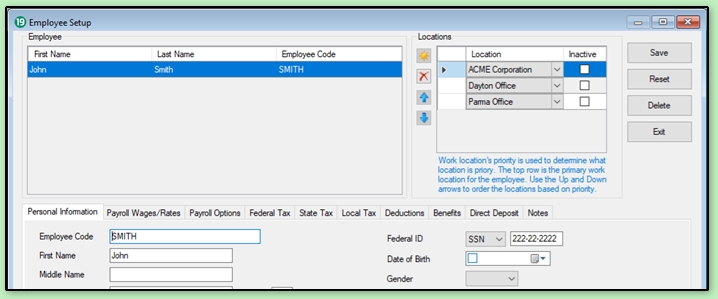

4. Multi-Location Payroll — Employee Setup

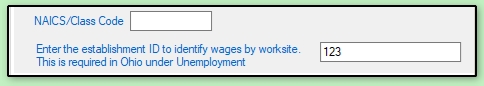

Location specific fields are highlighted for ease of identification. For example, in Ohio, the Establishment ID is location specific:

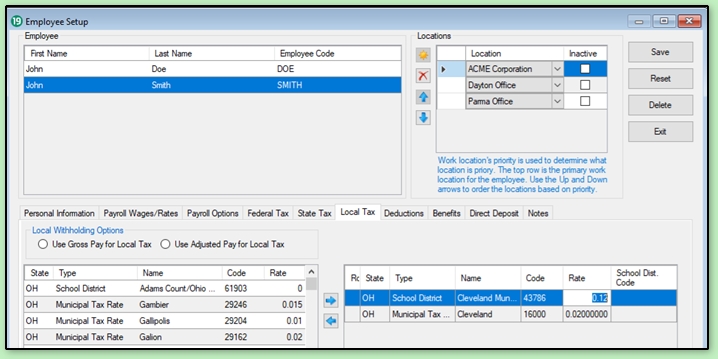

- Employee Information Defaults from Location

As shown below, the newly added employee inherits the location specific information as configured during location setup. These can then be customized or removed, and additional deductions, benefits, & local taxes may be added, if necessary.

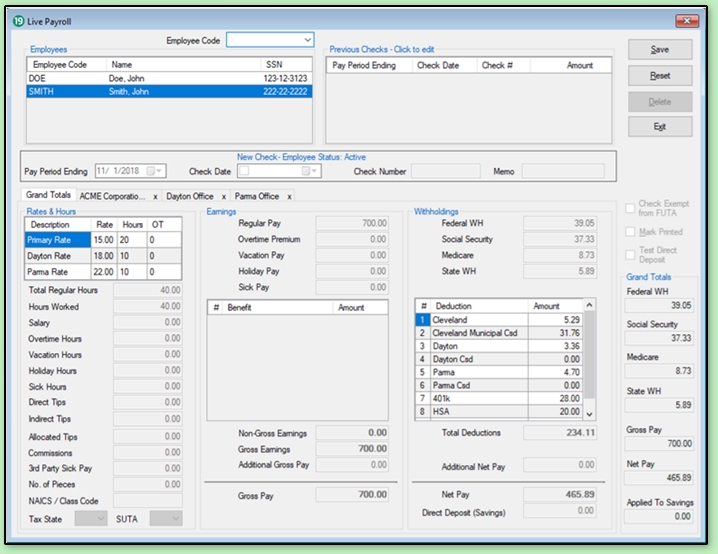

- Multi-Location as Reflected in Payroll

- Multi-Location Payroll Screen Features

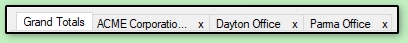

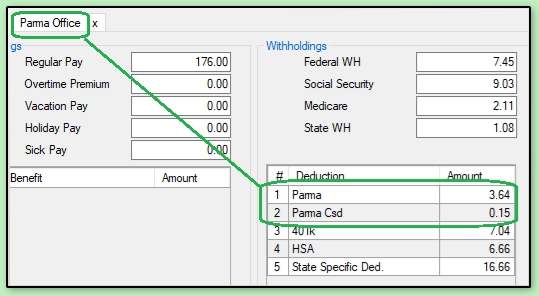

Tabs, located above the Rates and Hours, are used to navigate between locations for payroll data entry.

Note: The "x" to the right of a location can be used to bypass a location if the employee logged no hours there for the pay period.

Checks can be printed individually for each location, or combined into a single check for the pay period. When in combined checks mode, a grand totals tab presents the unified totals. For separate checks mode, the Grand Totals on the right side of the screen indicate total amounts:

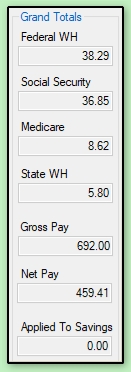

Localities are calculated only for hours entered at the specific location:

5. Accurate Calculations

As shown below, by the hours entered for each location and resulting Local Tax calculations, Drake Accounting® 2019 is now designed to fully support Multiple Locations for Payroll:

6. Employee Setup - State Tax & SUTA Selection

State Unemployment can also be localized according to the DOL rules for localization of services.

7. Payroll Screen - State Tax & SUTA Selection

Should the need arise, the state designated for State Tax and SUTA calculations can be overridden in payroll to reflect any required combination:

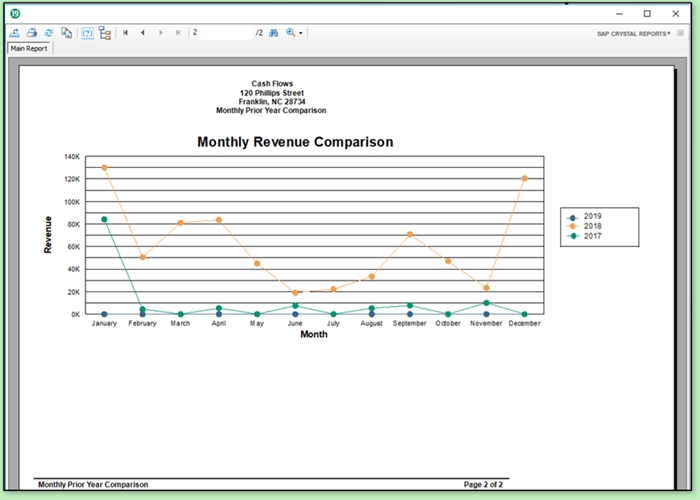

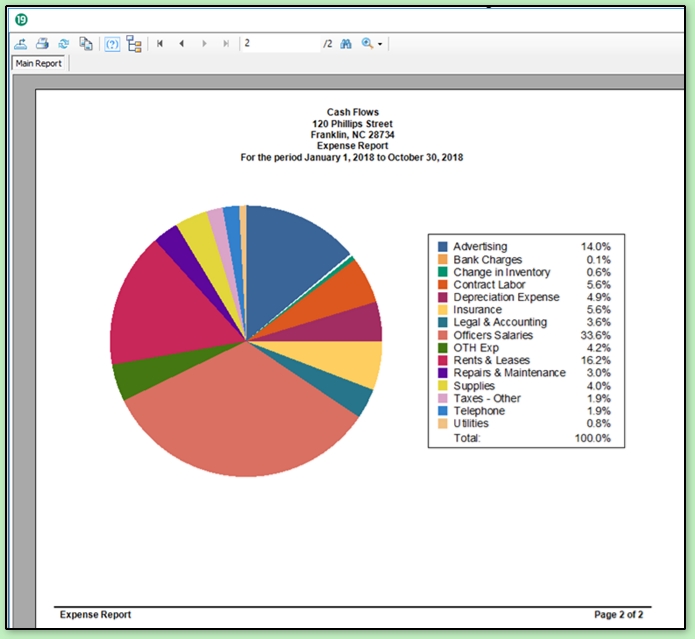

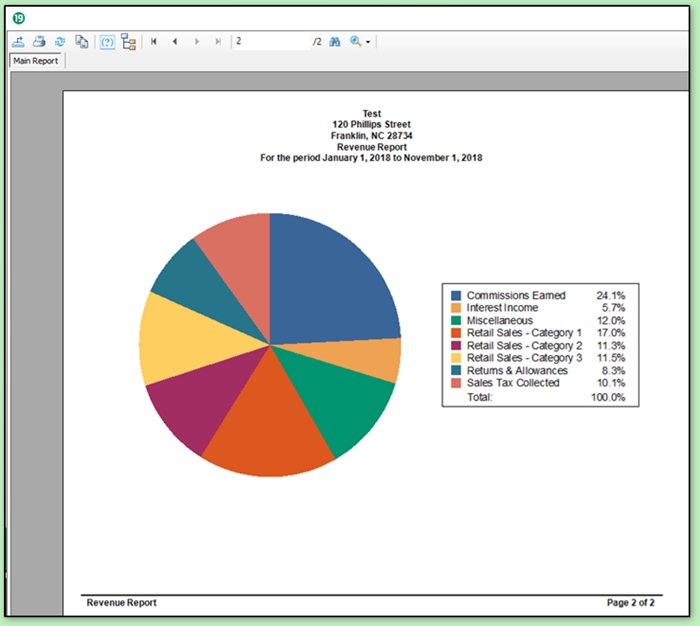

8. Graphical & Drill-Down Crystal Reports

- Drake Accounting® 2019 can now produce both Graphical and Drill-Down Crystal Reports for more informative, customer facing financial reports.

- Pie charts of Expenses and Revenue can be produced. Double-clicking on any portion of the pie chart opens up a detailed display of underlying financial data.

- Other reports with summary information on the main page, such as Profit & Loss statements, can be double-clicked to view detail as well.

Pie chart of Expenses:

Pie chart of Revenue:

Multi-Year Line Chart of Monthly Revenue: