How do I complete Form 4466 for a corporate return?

Form 4466 is the application for a refund when the corporation overpays on their estimated taxes and wants a refund of that amount to be processed quickly. This form does not replace any filing requirements of Form 1120 that the corporation may have.

Per the IRS,

"A corporation that overpaid its estimated tax for the tax year may apply for a quick refund if the overpayment is:

- At least 10% of the expected tax liability, and

- At least $500.

The overpayment is the excess of the estimated income tax the corporation paid during the tax year over the final income tax liability expected for the tax year, at the time this application is filed."

Creating Form 4466

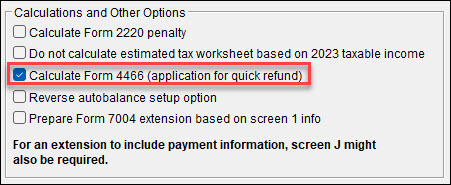

To generate this form in Drake Tax, first complete the ES screen to show the Estimated Taxes Paid (on the left side). This is needed to calculate lines 1 and 2 and allow the estimated tax deposit details to flow to Form 4466. Then, on the PRNT screen, check the box Calculate Form 4466 (application for quick refund). This will produce Form 4466 in View/Print mode.

Note: As the return changes, so do the values on Form 4466. If Form 4466 is completed and filed before the 1120 return is complete, you may need to use the override available on line 15 of screen J to enter the amount of 20YY refund applied for on Form 4466. This ensures that the amount reported on Form 1120, page 3, part III, line 15 matches the filed Form 4466.

This entry does not change the amount calculated on Form 4466, line 8.

Filing Form 4466:

Form 4466 must be filed by the regular due date of the corporate return with the appropriate IRS center. It must be filed before the tax return is filed. The IRS will review the form within 45 days of filing.

"File Form 4466 after the end of the corporation’s tax year, and no later than the due date for filing the corporation’s tax return (not including extensions). Form 4466 must be filed before the corporation files its tax return. An extension of time to file the corporation’s tax return will not extend the time for filing Form 4466."

"Complete and file an original, signed Form 4466 with the applicable

Internal Revenue Service Center... The corporation must also file Form 4466 with its income tax

return. Attach either the signed Form 4466 or an unsigned Form

4466 with the same information stated on the signed Form 4466."

Review the Form 4466 Instructions for more information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!