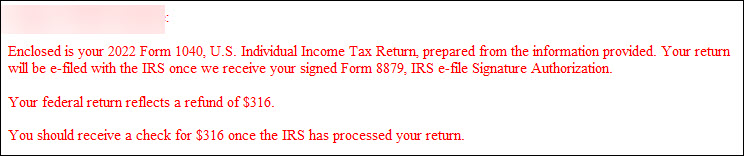

Why do all my letters say that the returns will be e-filed?

Returns that have not yet been accepted electronically will produce filing instructions and a client result letter with wording that indicates the return "will be e-filed..." This is true even if there are EF Messages still to be resolved in the return. This enhancement allows you to provide an accurate letter to your taxpayer at any point during return preparation.

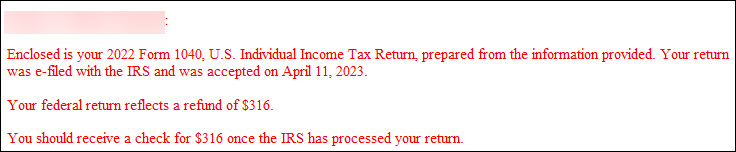

Once the return has been e-filed and accepted, the wording of the letter changes to say that the return "was e-filed..." and inserts the acknowledgement date from the ESUM screen. This updated letter can then be provided along with Form 9325 (1040 only) or the EF ACK page (business returns) that shows the submission ID for their records.

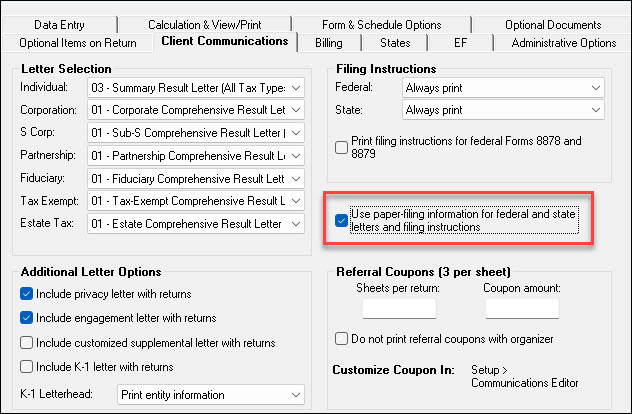

Global Settings

To change the global default setting to use paper-file information for all federal and state client result letters, and for federal and state filing instructions, go to Setup > Options > Client Communications tab and check the Use paper-filing instructions… check box > click OK.

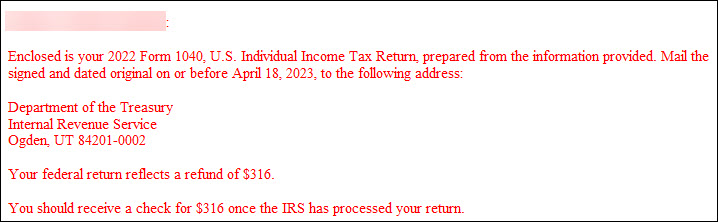

An example of the paper-file wording is shown below:

Return-by-return Settings

The Communications, COMM, screen of a return can be used for letter and filing instruction overrides.

In prior years, this was called the Letter or LTR screen.

To change the wording in a client result letter and filing instructions on a return-by-return basis, open the return, and from the COMM screen, select either EF or Paper from the Letter and Filing Instructions Options section at the bottom of the screen. This allows you to make adjustments as needed on a case-by-case basis.

Notes

Edits to the global letter templates can be made in Setup > Communications Editor. New keywords have been added to allow for the enhanced letter functionality.

The updated letters will now contain paragraphs concerning the handling of payments made after the due date as well as the above changes.

The wording is updated for federal, state, and city returns.

If you updated your letters from the prior year, you may have overwritten the new letter templates and may be seeing the wording used in prior years. Restore the default letter by going to Setup > Communications Editor > Open > select letter type > Setup > Restore Original Letter > Yes > Save.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!