Drake Accounting®: Review the following information about the California Employment Training Tax.

What is the California Employment Training Tax?

From the Employment Development Department of California (CA): The Employment Training Tax (ETT) “is an employer-paid tax” and “provides funds to train employees in targeted industries to make California businesses more competitive. ETT funds promote a healthy labor market, help businesses invest in a skilled and productive workforce, and develop the skills of workers who directly produce or deliver goods and services” See the website for more information at edd.ca.gov.

Summary of CA ETT Setup in Drake Accounting

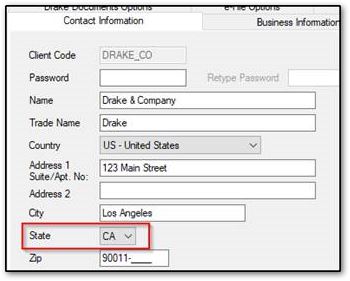

- Confirm your client’s state is CA under Client > Edit > Contact Information tab.

- Enter the rate for CA ETT under Firm > Rates & Withholding Setup > State Setup.

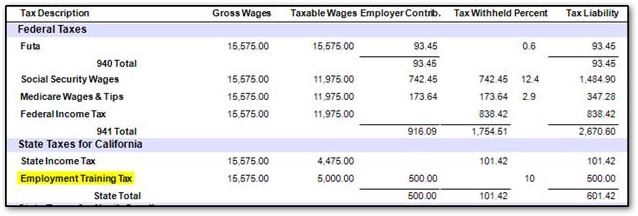

Note: The CA ETT will show up on the Tax Liability report under the Employer Contribution and Tax Liability columns after completing payroll. It will also show up on CA Forms DE-88 and DE-9/DE-9C under Employees > State Tax & Wage Forms. The amounts below are for demonstration purposes only.

Required Setup for the CA ETT Deduction

To set up this deduction in Drake Accounting:

- Confirm that your client’s state is CA under Client > Edit > Contact Information tab:

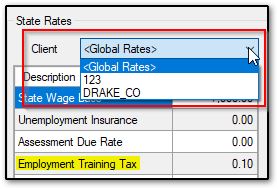

- Go to Firm > Rates & Withholding Setup > State Setup.

- Select CA under States on the left.

- Under the State Rates section, either:

- Use the Client drop down menu to either select a specific client to enter the ETT rate for, or

- Select <Global Rates> to apply the ETT rate you will enter to all the clients.

- Once you have selected a specific client or <Global Rates>, enter the CA ETT rate as a decimal.

- Information on the current rates can be found here.

- For example, 1% would be entered as .01, 20% would be entered as .20, etc. The amount entered below is for demonstration purposes only:

- Save when finished.

Finishing Steps

- Complete payroll under Employees > Payroll > Live or ATF.

- Complete CA Forms DE-88 and/or DE-9/DE-9C under Employees > State Tax & Wage Forms, as applicable.

- Go to Employees > Crystal Reports and choose the Tax Liability report.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!