How do I enter information for Form 1118 in a corporate return?

Form 1118 in a corporate return is calculated based on the entries made on the Foreign Tax Credit screens (available on the first Credits tab in the Data Entry Menu). Per the IRS, a separate set of screens must be completed for each country and category of income.

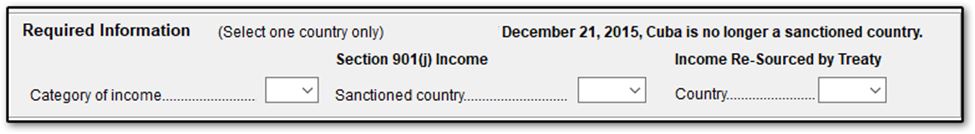

If the credit is not calculating as expected, verify that the selection made in the Required Information section of each screen matches the other screens related to that country/category of income. If there are multiple categories of income, or countries for which a credit can be calculated, complete each foreign tax screen for the first country/category, then press Page Down to create additional screens as needed.

For example, if the corporation had both passive category income and general category income, the following entries (at minimum) are required:

- On screen 18A, choose 1 from the Category of Income drop list. Enter the foreign income and deduction amounts as applicable.

- Press Page Down, and on a second instance of screen 18A, choose 2 from the Category of Income drop list. Enter the foreign income and deduction amounts as applicable.

- On screen 18B, choose 1 from the Category of Income drop list. Enter the foreign tax paid or accrued as applicable.

- Press Page Down, and on a second instance of screen 18B, choose 2 from the Category of Income drop list. Enter the foreign tax paid or accrued as applicable.

- Create instances of the other foreign tax screens in the same manner as above (if needed).

Note that a credit calculation requires both foreign income and foreign taxes paid or accrued. Other limitations may apply based on the return details. Review Forms 1118 in View/Print mode to see the calculation of each credit amount (Form 1118, Schedule B, Part II). If calculated, the total Foreign Tax Credit flows to Form 1120, Page 3, line 5a.

Common EF Messages

-

EF Message 0308: The category on screen 18A does not match the category selection on screen 18B and/or 18J.

-

EF Message 0313: The category on screen 18A does not match 18J.

-

EF Message 0091: A selection was made in more than one drop list under Required Information. A separate screen is required for each income type.

-

EF Messages 0092, 0093, or 0094: A missing or invalid date for taxes paid or taxes accrued was entered on screen 18B.

- EF Message 0095: Produced if you have one or more foreign tax screens on which a Category of Income type, a Sanctioned country, or an Income re-sourced by Treaty country is not selected from the drop list. (Note that you can make a selection from one drop list only.)

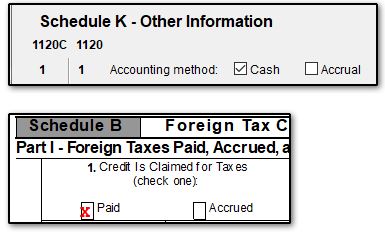

Paid or Accrued Checkbox

Form 1118, Schedule B, Part I, line 1 is shown as either “Paid” or “Accrued,” depending on the selection you made on screen K screen for line 1, Accounting Method. If you select Cash on screen K, "Paid" is marked on Schedule B; if you select Accrual, "Accrued" is marked. The date paid or accrued is entered on screen 18B.

Cuba

Per the IRS, as of December 22, 2015, Cuba is no longer a sanctioned country.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!