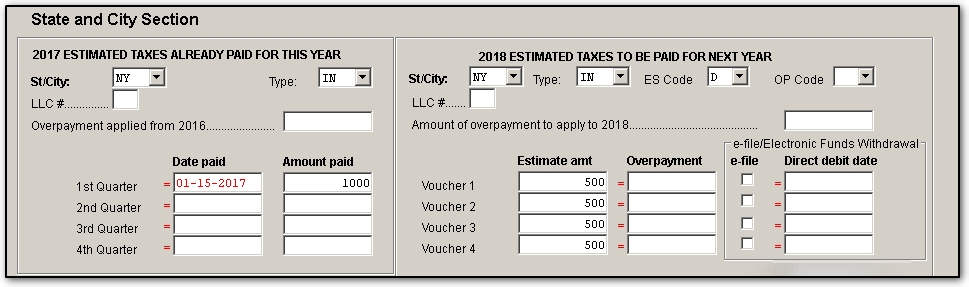

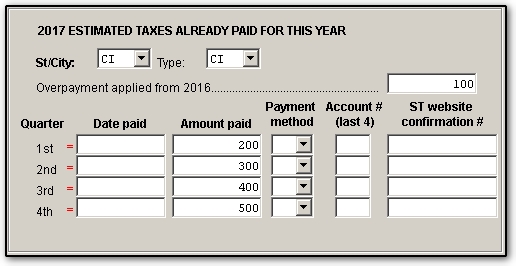

If the taxpayer made prepayments to New York and/or New York City, you can enter those on the federal ES screen. (Miscellaneous tab in business packages) (General tab in individual package).

To get the payments to flow to the New York return, in the St/City box select NY

The Type selection will tell the software specifically where the amount will flow to. The Options are:

- IN - State Individual Income Tax

- CI - New York City Income Tax

- MT - NY (MCTMT) Metropolitan Commuter Transportation Mobility Tax

- M2 - (Same as MT, but flows to Federal Schedule A)

- YO - Yonkers Resident Surcharge/Non-Resident Earnings Tax

Note: Press Page Down on your keyboard if additional entries are necessary. For example, enter Federal and the NY state estimates on the first screen and then NY city estimates on the second screen.

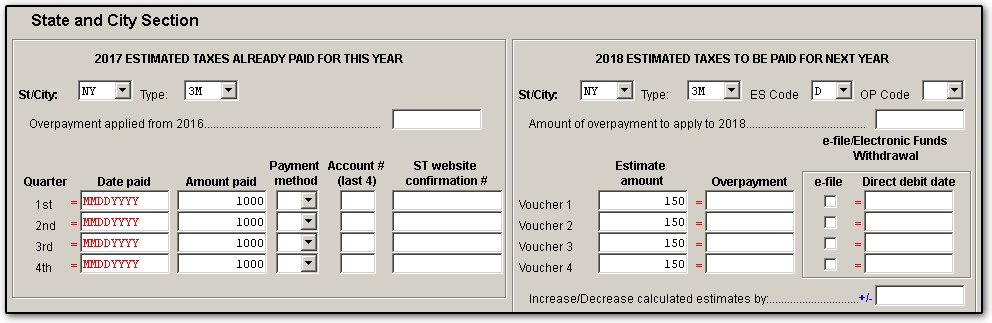

To generate NY ES vouchers, Under the 20YY ESTIMATED TAXES TO BE PAID FOR NEXT YEAR, select NY as the State and the Type as IN.

The ES code is a required selection, simply choose how you want the vouchers to round. If you are unsure of what to choose, ES Code D will round to the nearest $1. Unless you choose to print blank vouchers (ES Code P), the software will determine the amount of the vouchers automatically based on the return. If you prefer to enter an amount to print on the vouchers, enter the estimate amount in the boxes below Estimate amt for Voucher 1-4.

Note: NY does not generate joint vouchers. On the federal ES screen, if you have the TSJ code as J, the state program for NY will split the estimate amounts between the taxpayer and spouse on separate vouchers. For example, if you have first quarter estimate as $1,000, the state will generate 2 vouchers for $500. One for the taxpayer, and one for the spouse.

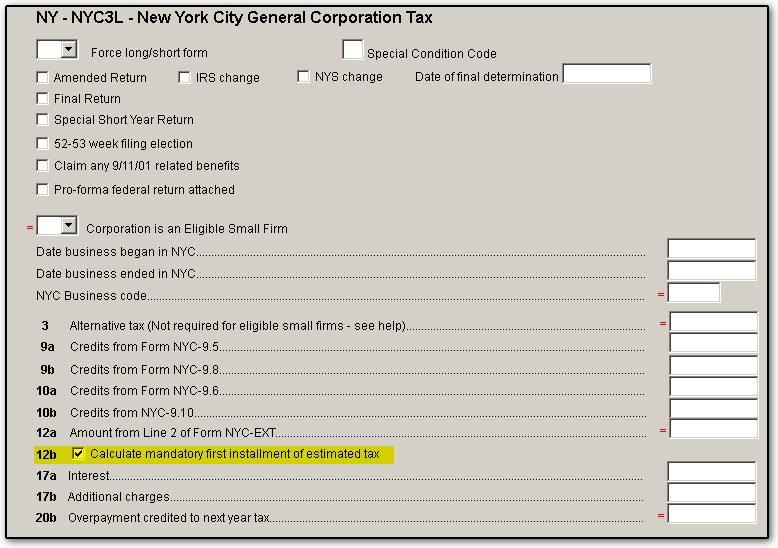

- Navigate to the New York Cities tab.

- Open screen 3L1, NYC 3L - General Information & Computation of Tax.

- Check the box on line 12b, Calculate mandatory first installment of estimated tax.

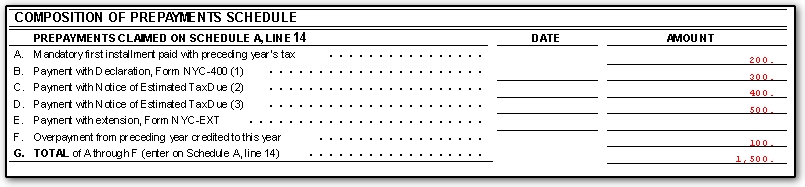

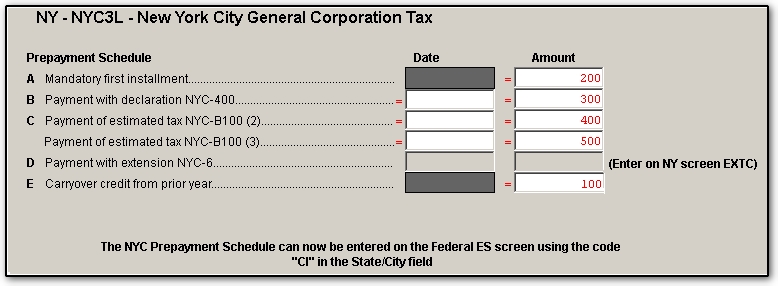

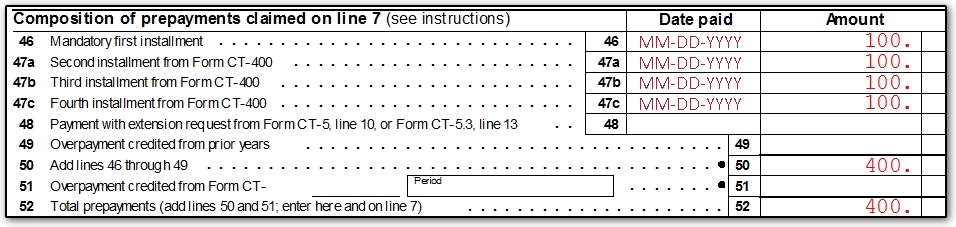

On NYC-3L, you will find the composition of prepayments schedule on page 2.

To get the prepayment information to populate, you have two options.

- NY screen 3L10

or

- Federal ES screen

- Select CI for the St/City as well as the Type in this scenario.

To answer the Metropolitan transportation business tax (MTA surcharge) question:

- Go to NY screen 1, CT-3 – General Business Corporation Franchise Tax Return

- Select Yes or No from the drop list for the field, "Are you subject to the MTA Surcharge."

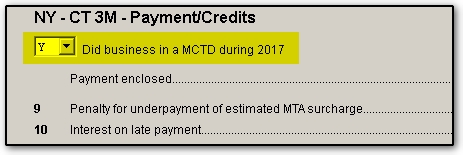

On the federal ES screen, enter NY as the St/City and 3M as the Type. Estimated taxes paid during the tax year are entered on the left section and estimated payments to be made in the coming year are entered on the right section. Be sure to answer the question Did business in a MCTD during 20YY on NY screen 16 for payments to flow.

- Estimated taxes already paid for this year: These payments appear on Form CT-3M on lines 46 - 47c, and the total appears on line 7.

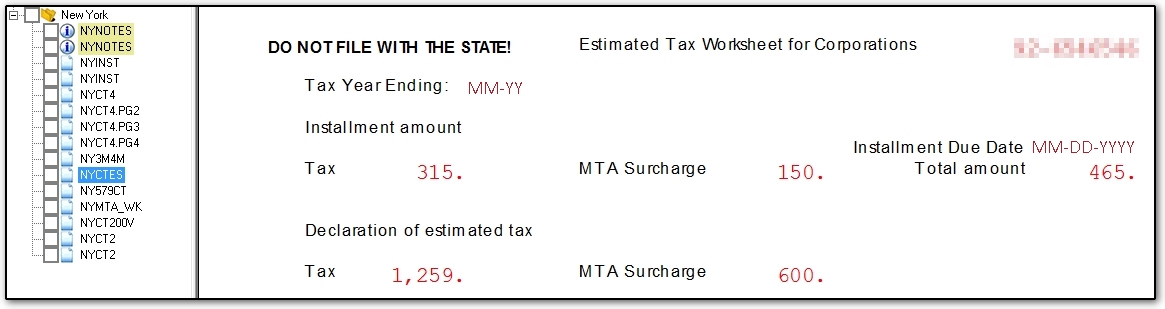

- Estimated taxes to be paid for next year. The estimated payments appear on the MTA Surcharge line on the NY estimated tax worksheet, NYCTES.

Your corporate client can pay estimated taxes for New York corporate returns through its Online Services account at the New York Department of Taxation and Finance website. For more information, go to Corporation Tax Web File. Drake Software generates the NYCTES worksheet, which provides the information for the online payment.

Note: Beginning in Drake17, ES payments can be made or scheduled via Direct Debit with an e-filed return

Most Corporations are now required to file Estimated Tax for Corporations electronically. According to the NY Department of Taxation and Finance, corporations electing to electronically file their New York State tax return must pay online using direct debit or ACH Credit. See e-file mandate and filing/payment methods on the NY DTF website.

You have to inform the software that the corporation is subject to the MTA surcharge. To do this, go to NY screen 16, CT-3-M– Payments and Credits and select Y from the drop list for the question, "Did business in a MCTD during 20YY."

This will generate a CT3M/4M General Business Corporation MTA Surcharge Return. The results will flow to the appropriate lines on the NY CT5 Request for Six-Month Extension to File.

The NYC-

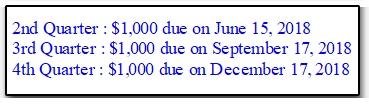

400, Declaration Of Estimated Tax By General Corporations, does not require a fourth voucher.

A first payment of estimated tax (if required) is made with form CT-300 and NYC-300. The NYC-400 specifies paying the balance in three installments during the succeeding year (see the instructions on page 2 of the form).

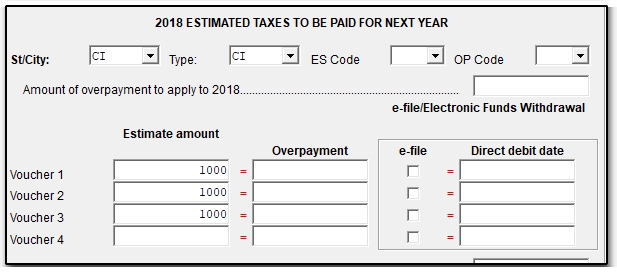

To generate estimated vouchers 2, 3, and/or 4, you will need to enter the amounts in Estimate amount boxes 1-3 as seen below.

Federal ES Screen:

Result Letter:

Forms List in View:

The balance due will only produce in one location:

- Line A on the form: A CT-3-S return that is not eligible for e-filing displays the full balance due on line A. Because of this, there is no voucher.

or

- the CT-200V, voucher: A CT-3-S return that is eligible for e-filing displays the full payment on the CT-200V, unless you are making a payment on the PMT screen.

The amount entered on the PMT screen is displayed on line A of the return because the payment is accompanying the return.

Note: The CT-200V is a mail-in Payment Voucher for E-Filed Corporation Tax Returns and Extensions; thus, it only produces if there is an expectation of a payment to be made that will not be accompanying the tax return.

Beginning in Drake17, the default payment date of an e-filed NY/NYC return is the date the return is filed, per a new Department of Taxation and Finance specification. The requested payment date may still be overridden to any date, up to the due date of the return.

If the taxpayer does not want the amount due to be withdrawn on the date that the return is e-filed, a different requested payment date must be entered in the Requested Payment Date box on the PMT screen.

Note: The requested payment date cannot be later than the due date of the return. NY DTF does not allow post-dating of payments after the due date of the return.

You can verify the withdrawal date in the following locations in view mode:

- NY 201.PG4, line 84 or NY 203.PG4, line 74

- NYINST page

- Transaction Summary

- Result Letter