How do I e-file a split return?

After you split a return, if you have previously opened either split return, (or have run Tools > Repair Index Files), the return is visible on the Open/Create a New Return dialog box All Clients list and can be selected from the list. Otherwise, use the taxpayer or spouse's SSN to open the return.

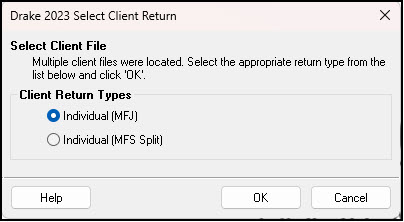

When you open the primary taxpayer's split return, you are prompted for which return to open - Individual (MFJ) or Individual (MFS Split) (because the SSNs on the original MFJ and on the primary taxpayer's split return are the same). Select Individual (MFS Split) and click OK.

Note: Take care not to e-file the original MFJ return. It's a good idea to disable it from e-filing by deleting the PIN screen or selecting Suppress All e-File on the EF screen in the return(s) that should not be filed.

To e-file the split returns

Prepare the split returns as you ordinarily do, calculating the returns and clearing all messages.

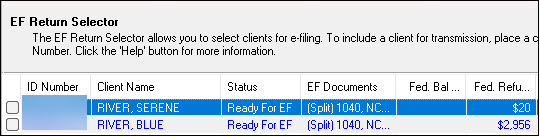

When the returns are eligible for e-filing, they appear on the EF Selector in blue highlight, with a "split" notation in the EF Documents and Fed EF columns:

If you need to file the federal return as MFJ, and then separate state returns, follow these basic steps:

- Prepare the joint and split returns as you ordinarily do, calculating the returns and clearing all messages.

- In the MFJ return, suppress the state by selecting Do NOT send any states on the EF screen.

- In each of the split returns, suppress the federal by selecting Do NOT send Federal on the EF screen.

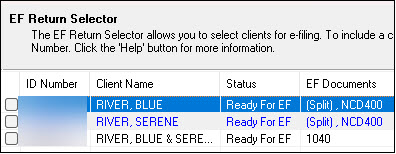

- When the returns are eligible for e-filing, the split returns appear on the EF Selector in blue highlight, with a "split" notation in the EF Documents column; and the joint return appears on the EF Selector in black lettering, with 1040 notation in the EF Document column:

Always verify the return(s) being selected for transmission by going to calculate or reviewing the EF Status page in view mode. A return cannot be stopped once it has been transmitted.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!