Review the following frequently asked questions about Form KS120EX, Kansas Expensing Deduction Schedule.

What is the KS120EX?

The KS120EX provides a deduction for the depreciation expense associated with an asset placed into service in Kansas during the current tax year. The deduction uses a designated multiple found in the KS 120EX instructions and applies it against the asset’s net basis. For KS120EX purposes, the asset’s net basis is determined by deducting current year bonus depreciation from the asset’s original cost.

How do I generate the KS120EX?

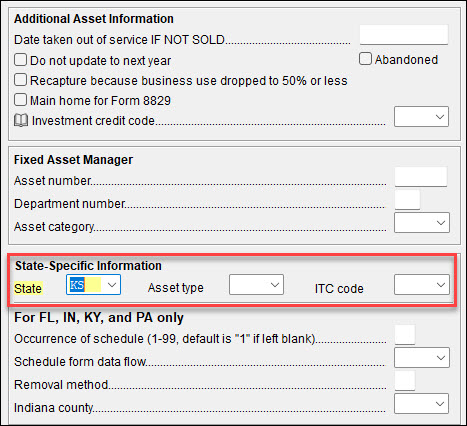

There are two ways a preparer can generate the KS120EX in the Drake Tax package. The first method is to link Kansas to the appropriate asset listed on the federal 4562 screen:

The second way is to enter the qualifying assets directly on the KS EXB screen. This screen is found on the General tab in the Kansas data entry menu.

Will this credit be used in all packages? If so, what differences exist between these packages?

The KS120EX is functional in all of the Kansas packages. As each package is driven by a different set of tax law rules, you will notice slight differences in how each package handles the KS120EX. Some of these differences are listed below:

- Partnership and S corporation packages (KS120S). Partnerships and S corporations are flow-through entities, so this deduction eventually is reported on each partner or shareholder's individual return. Drake provides each partner or shareholder with a copy of the first page of the KS120EX, as well as a copy of the second page, which itemizes the assets used in the total deduction’s calculation. This information will help in the preparation of individual returns.

- Corporations (KS120). As multiple corporations can be combined into one package, the KS120EX can be the aggregate of each corporation’s individual expensing deduction. This consolidation is handled in Part A (KS screen EX1) as the total expensing deduction from each separate corporation will offset the deduction claimed by the single corporation. Additionally, any excess expensing deduction can be carried forward to offset the corporation’s taxable income in future years.

See the Kansas Expensing Deduction Schedule and Instructions for more information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!