Where do I enter education credits for taxpayers and dependents in Drake Tax?

This article discusses education credits. For information about the tuition and fees deduction, see Related Links below.

The Lifetime Learning Credit and American Opportunity Credits can be taken only for a qualifying dependent, taxpayer, or spouse. There are limitations for each of these credits. Enter Lifetime Learning and American Opportunity credits on the 8863 screen; education credits appear on Form 8863 in view mode.

Comparison of Credits (adapted from the Form 8863 Instructions):

| Maximum credit |

Up to S2,500 credit per eligible student |

Up to $2,000 credit per return |

| Limit on modified adjusted gross income (MAGI) |

$180,000 if married filing jointly; $90,000 if single, head of household, or qualifying surviving spouse |

$180,000 if married filing jointly; $90,000 if single, head of household, or qualifying surviving spouse |

| Refundable or nonrefundable |

40% of credit may be refundable; the rest is nonrefundable |

Nonrefundable—credit limited to the amount of tax you must pay on your taxable income |

| Number of years of post-secondary education |

Available ONLY if the student had not completed the first 4 years of post-secondary education before 2023 |

Available for all years of post-secondary education and for courses to acquire or improve job skills |

| Number of tax years credit available |

Available ONLY for 4 tax years per eligible student |

Available for an unlimited number of tax years |

| Type of program required |

Student must be pursuing a program leading to a degree or other recognized education credential |

Student doesn't need to be pursuing a program leading to a degree or other recognized education credential |

| Number of courses |

Student must be enrolled at least half-time for at least one academic period beginning during 20YY (or the first 3 months of 20ZZ if the qualified expenses were paid in |

Available for one or more courses |

| Felony drug conviction |

As of the end of 20YY the student had not been convicted of a felony for possessing or distributing a controlled substance |

Felony drug convictions don't make the student ineligible |

| Qualified expenses |

Tuition, required enrollment fees, and course materials that the student needs for a course of study whether or not the materials are bought at the educational institution as a condition of enrollment or attendance |

Tuition and required enrollment fees (including amounts required to be paid to the institution for course-related books, supplies, and equipment) |

| Payments for academic periods |

Payments made in 20YY for academic periods beginning in 20YY or beginning in the first 3 months of 20ZZ |

Payments made in 20YY for academic periods beginning in 20YY or beginning in the first 3 months of 20ZZ |

| TIN needed by filing due date |

Filers and students must have been issued a TIN by the due date of their 20YY return (including extensions) |

Students must have been issued a TIN by the due date of their 20YY return (including extensions) |

| Educational institution's EIN |

You must provide the educational institution's employer identification number (EIN) on your Form 8863 |

Educational institution’s employer identification number (EIN) is not required on your Form 8863 |

Other Notes:

- Filing status cannot be Married Filing Separate (MFS).

- Cannot be the dependent of another.

- Cannot claim both credits for the same student in the same year.

- Entries for dependents, taxpayer, or spouse go on Screen 8863. Choose the SSN from the drop list and create a new screen (Page Down) for each student.

Data Entry

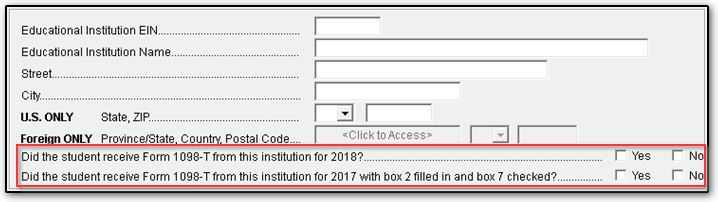

Form 1098-T Tuition Statement will assist you in entering AOTC or Lifetime Learning Credits. On the 8863 screen, choose the student’s SSN from the drop list under Student’s SSN. If a dependent who is over 18 does not show on the list, check data entry for that dependent to be sure Over 18 and a student has been selected. You may need to recalculate the return to have the SSN appear in the drop list.

A separate 8863 screen is needed for each student for whom a credit is claimed. Multiple schools attended by the same student can be entered on the 8863 screen by using the Educational Institutions tab located at the top of the screen.

Enter in applicable expenses and education assistance amounts in the lines below question 26 on the screen. Then, check the education benefit being claimed to have the software calculate the credit amount for the student. These check-boxes are mutually exclusive since only one benefit can be claimed for the same individual in the same year:

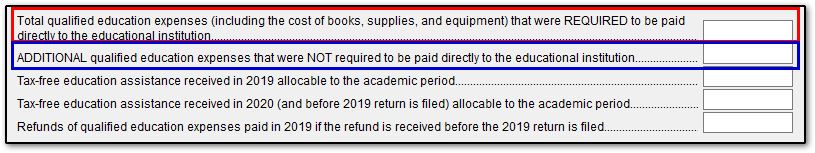

Note about Qualified Education Expenses:

Per the 8863 Instructions, each credit only allows certain expenses to be included for the credit calculation. You can enter the amounts as applicable on the 8863 screen and Drake Tax will only carry the allowable amount to the form. This is why there are separate lines for expenses required to be paid (red) and additional expenses not required to be paid (blue) to the educational institution:

- American opportunity credit: Qualified education expenses include amounts paid for tuition, fees, and course materials, which include books, supplies, and equipment needed for a course of study, whether or not the materials are purchased from the educational institution as a condition of enrollment or attendance.

- Lifetime learning credit: Qualified education expenses include amounts paid for books, supplies, and equipment only if required to be paid to the institution as a condition of enrollment or attendance.

- The credit will only be based on the amounts required to be paid (red box above).

For more information see:

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!