Who is required to have a New Mexico CRS Identification Number? Where do I enter it in the software?

New Mexico requires anyone engaged in business in New Mexico to register with the Taxation and Revenue Department. During registration, each business will be provided with a State Tax ID number, also known as a Combined Reporting System (CRS) ID Number. This registration it is used to report and pay tax collected on gross receipts from business conducted in New Mexico.

Employees who receive a W-2 from a firm or company are not required to apply for their own CRS ID Number. Instead, these employees will be allowed to use the firm’s CRS ID Number when preparing returns.

Anyone meeting the definition of a contractor must apply for their own CRS ID Number. These contractors will not be permitted to use the firm’s CRS ID Number.

To apply for a CRS ID number or for more information on the topic, visit NM’s website at https://www.tax.newmexico.gov/businesses/who-must-register-a-business/.

Where to enter in the Software

The CRS ID may be entered under the State ID number in Setup > Firm > Settings tab.

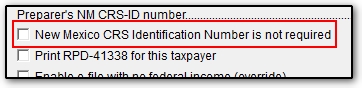

If you are not required to have a CRS ID, check the box at the bottom of NM screen 1.

If the number is missing or incorrect, you may see NM EF Message 0471 when viewing the return.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!