What are add-on fees? How do I set up an add-on fee for the returns I transmit with a bank product?

Banks allow you to include an additional fee to a return when using a bank product. This is in addition to any preparer fees that you have set up in the software. This add-on fee is deducted from the taxpayer’s refund and held in a separate bank account, from which monthly distributions are made to preparers around the middle of each month for returns acknowledged and accepted, and fully funded during the preceding month. The funding date, rather than the transmission date, is what determines when the deposit will be made. Note that Drake charges a 5% convenience fee for facilitating the add-on fee processing (withheld from the deposit).

Note: If this office is associated with a master EFIN in Drake Software’s accounting database, the add-on fees will be paid to the indicated master EFIN.

Similar to the add-on fee, Tax Product Group (TPG), Republic, and Refundo also allow a Document Prep Fee to be included. These fees are paid when the preparer fees are paid (not withheld like add-on fees).

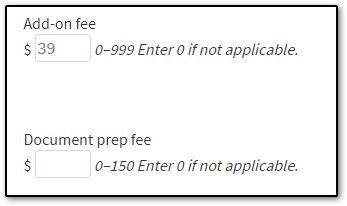

Add-on fees and Document prep fee maximum amounts may vary depending on the bank with whom you are partnered.

Note: Distributions are made to the office bank account identified in your online Drake bank application, or to a separate bank account if indicated in the Support website > Account > Direct Deposit Information under Add On fees.

These fees are optional and can be set at Setup > Firms when you set up or edit a firm once your Drake online bank application has been approved.

Click the Confirm button when setting up your bank information under Setup > Firms to prevent this mismatch.

Note: The Confirm button is the only way of modifying your Setup> Firms > Banking information.

To view a report of add-on fees:

- showing the total add-on revenue, log in to the Support website, then select Reports > Add-on Fees on the left side of the page.

- showing breakout of add-on fees by individual returns, log in to Drake Support and look at the add-on fee column in the Fees report in your Online Database.

Some states put additional restrictions on what types of additional fees may be charged for taxpayers with bank products. Those states are Arkansas, Connecticut, Illinois, Maryland, and New York. For Maine, preparers should contact the banking commission for details on any restrictions.

Is there a place where I can check the status of my add-on fee earnings?

To run a report for the add-on fees your office has accrued, log into the Support website. Select Add-on Fees from the Reports menu. Select the year and an individual month as the time period for the report, or select the year and YTD (Year to Date) to generate a report for the entire filing year.

When the report is displayed, you can see the breakdown for your office by clicking the link to your EFIN (under the EFIN column).

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!