Choose from the following frequently asked questions about Identity Protection Personal Identification Numbers (IP PIN):

- What is an Identity Protection PIN?

- Where would I enter an Identity Protection PIN for the taxpayer and/or spouse?

- Where do I enter an Identity Protection PIN for a dependent and/or qualified person?

- What is Form 14039?

- What reject codes are related to the IP PIN?

- Helpful Links

What is an Identity Protection PIN?

An IP PIN is an identity protection PIN issued by the IRS to certain taxpayers. It is designed to help combat ID theft by preventing someone else from filing a tax return using the taxpayer's SSN.

- New IP PINs are issued every year. An IP PIN consists of a six-digit number. If it was issued with only five digits, enter a 0 (zero) as the first digit.

- The IP PIN is for the current filing season and used in addition to the taxpayer’s 5-digit PIN that is entered on the PIN screen.

- If filing returns for multiple tax years, the IP PIN is used for both current and prior-year returns filed in that year.

- IP PINs are not self-selected. Entering a six-digit number in the IP PIN fields in a return does not select a new IP PIN for the taxpayer. The taxpayer has to ask for, and be issued one by the IRS.

- Taxpayers who document that they have experienced or been exposed to identity theft may receive a six-digit Identity Protection PIN (IP PIN) from the IRS in a CP01 notice and an explanation in a CP01A notice.

- Starting in 2021, taxpayers can voluntarily apply for an IP PIN number without having to have a documented ID theft incident. To do so, taxpayers must apply online. See Related Links below and the informational video from the IRS for details.

- According to the IRS, IP PIN numbers must be entered for all IP PIN holders whether or not the SSN is for a primary, secondary, or dependent taxpayer.

- Returns for taxpayers that have been issued an IP PIN will be rejected through the e-file system if the IP PIN is not entered for any applicable primary, secondary, or dependent individuals. If an incorrect IP PIN is issued, the return will also be rejected.

Where would I enter an Identity Protection PIN for the primary taxpayer and/or spouse?

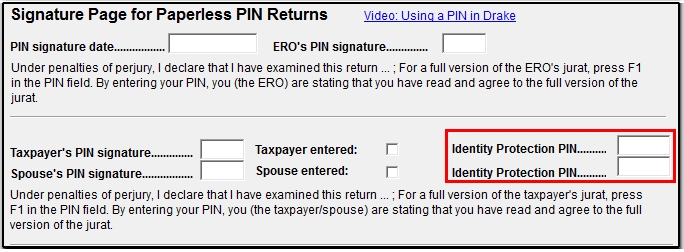

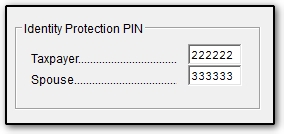

Identity Protection PINs for the primary taxpayer and/or spouse are entered on the PIN screen, to the right of the regular PIN signature:

In 2017 and prior, the IP PIN for the spouse was not printed on Form 1040, but was still required for e-filing, if issued. Starting with Drake18, the spouse's IP PIN is printed below the taxpayer's IP PIN in the signature section on Form 1040.

- In Drake 14 and prior, enter an IP PIN on the MISC screen. You also can open the MISC screen from the PIN screen using the Identity Protection PIN link (to the right of the taxpayer PIN signature fields).

Where do I enter an Identity Protection PIN for a dependent and/or qualified person?

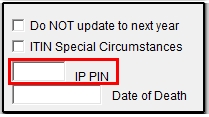

Beginning in Drake15, the Dependent IP PIN fields is located on screen 2 at the bottom right:

The dependent's IP PIN does not appear in view mode on any forms, however, it is required for e-filing, if assigned.

- In 2014 and prior, the IRS did not required a dependent's IP PIN in a return and there is no field for entry in Drake14 and prior.

What is Form 14039?

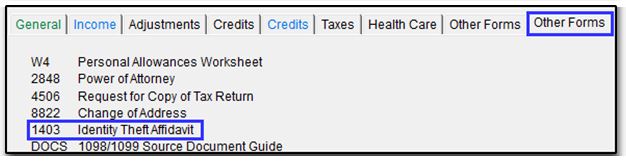

Beginning with Drake15, Form 14039, Identity Theft Affidavit, may be completed in Drake Software by completing the 1403 screen located on the second Other Forms tab.

Submit a completed form for each taxpayer, as needed, along with clear and legible copies of required documentation, either by mail to the address on the bottom of the form, or by fax to the number given.

Note: Form 14039 cannot be e-filed. A fillable form is also available online at the IRS website: Form 14039 Identity Theft Affidavit.

What rejects are related to the IP PIN?

In order to avoid rejects pertaining to the Identity Protection PIN, it is important to ensure that the taxpayer includes their most recently issued IP PIN. The taxpayer receives a new IP PIN Letter CP01-A from the IRS each year. IP PINs from prior years cannot be used to e-file a return in the current year.

The following rejects are also related to invalid IP PINs:

- IND-180-01

- IND-181-01

- IND-182-01

- IND-183-01

- IND-995

- IND-996

Visit www.irs.gov/get-an-ippin for further information or to retrieve the current IP PIN. Enter it on the PIN screen or screen 2 as needed.

Helpful Links

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!