Where can I report an Indiana private school/home school deduction in Drake Tax?

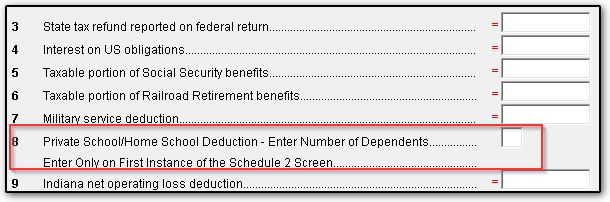

To enter the IN private school/home school deduction in Drake Tax, go to the Indiana Data Entry > Deductions tab > SCH2 screen. On line 8 of the SCH2 screen, there is a Private School/Home School Deduction. Enter the number of qualifying dependents on which the deduction should be calculated.

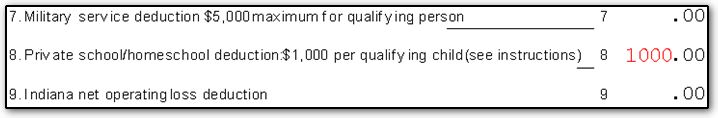

The software will automatically calculate the allowable deduction on line 8 of Indiana Schedule 2 in View/Print mode:

Per the IN IT-40 Instructions:

"You may be eligible for a deduction based on education expenditures paid for each dependent child who is enrolled in a private school or is homeschooled.

Dependent Child Qualifications

- Your dependent child must be eligible to receive a free elementary or high school education (K-12 range) in an Indiana school corporation;

- You must be eligible to claim the child as a dependent on your federal tax return; and

- The child must be your natural or adopted child or, if not, you must have been awarded custody of the child in a court proceeding making you the court appointed guardian or custodian of the child."

For more information on the private school/homeschool deduction or the SCH2, see the IN IT-40 Instructions or Related Links below.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!