I have a client that was issued a 1099-R with a code of 4 indicating it is for death benefits. How can I exclude the death benefits from my Colorado return?

If the taxpayer/spouse was not 55 years of age as of Dec. 31, they do not qualify for the pension exclusion unless they are receiving the pension as a secondary beneficiary (such as a widow or a dependent child) due to the death of the person who earned the pension, in which case they may exclude the smaller of such income or $20,000.

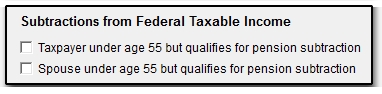

To exclude a 1099-R that was issued due to death to someone under the age of 55, you can go to the States tab > CO > screen 2 (104 Additions and Subtractions). In the Subtractions section, select Taxpayer/Spouse under age 55 but qualifies for pension subtraction check box. The pension subtraction will show on CO 104 AD, line 3 (for taxpayer) or line 4 (for spouse).

For more information on CO pension subtractions, see the CO 104 Booklet.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!