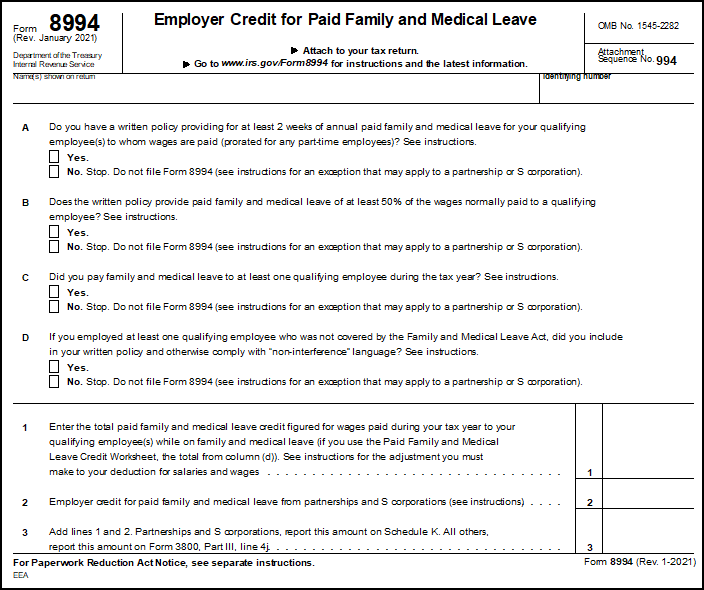

What is Form 8994 and what is it used for?

For tax years starting after December 31, 2017, the Tax Cuts and Jobs Act (see page 82) introduced a credit for eligible employers who paid family and medical leave for tax years beginning after 2017. According to the instructions for form 8994, the credit ranges from 12.5% to 25% of wages paid to a qualifying employee while the employee is on family and medical leave.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!