There is Illinois state withholding reported on a K1P/K1S/K1F, but it is not flowing to the IL 1040.

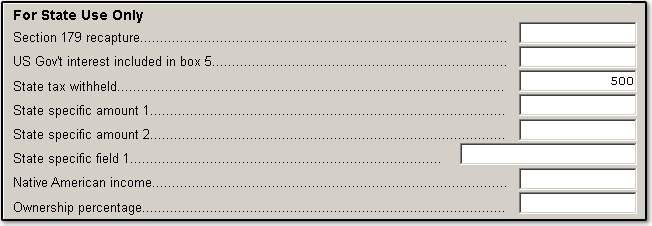

If there is state withholding reported on a Schedule K-1 for an individual, this information should be entered on the applicable federal K1 screen in the State Use Only section (second tab of the applicable K1 screen).

If Illinois is not the resident state, select IL from the ST drop box at the top of the federal K1 screen.

Once the information has been entered on the federal screen, select the States tab, then Illinois. On the K1s tab, open the applicable K1 screen (K1P for partners/shareholders or K1T for beneficiaries).

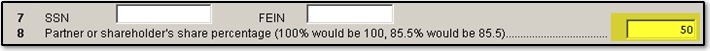

- Select T for taxpayer or S for spouse in the TS box.

- In the EIN/Name field, select the federal K-1 reporting the withholding.

- If entering on the K1P screen, enter the partner/shareholder ownership percentage on line 8.

Note: If the federal K1 does not display (or displays incorrectly) in the EIN/Name drop box on the IL K1 screen, calculate the return to update the information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!