Where do I enter state pass-through entity tax (PTET) in the 1065 and 1120-S packages?

The PTET allows electing S corporations or partnerships to be

taxed at the entity level, which

allows eligible shareholders and partners to take the credit on their individual

return for taxes paid. Doing so bypasses the state and local tax (SALT) limitation of $10,000.

Enter state pass-through entity tax estimates on the ESTIMATED TAXES TO BE PAID FOR NEXT YEAR section of screen ES with

the appropriate state PTET selected from the Type drop list. The amounts entered here automatically

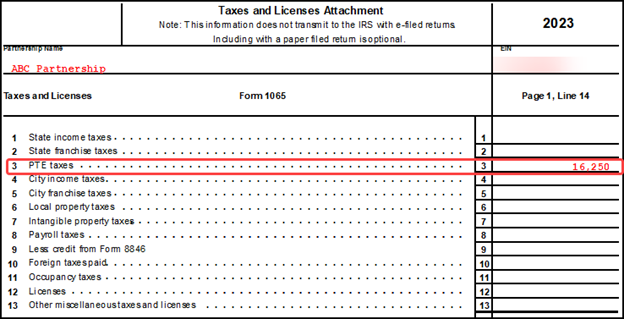

flow to the "PTE taxes" line of the Taxes and Licenses Attachment

("Wks Tax/Lic" in View/Print mode) as well as the "Taxes and

licenses" line of the main form.

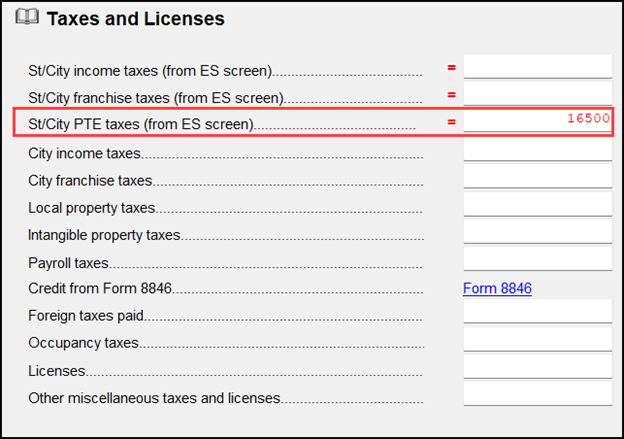

To override the amount that flows from screen ES, go

to screen DED and select the Detail link next to the Taxes and

licenses field. On the Taxes and Licenses screen, enter the desired amount in the ST/City PTE taxes (from ES screen)

field.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!