Can I e-file a return with an ITIN on screen 1 and an SSN on the W-2?

Yes, however, you must enter the employee's identification number in the ITIN override field at the bottom of screen W2 exactly as it appears on the employer-issued Form W-2.

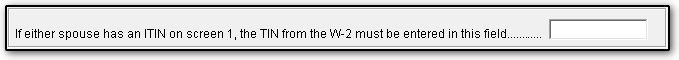

In an individual return, the program does not use a taxpayer’s or spouse's ITIN from screen 1 as the default for the box "Employee's social security number" on the W2. It remains blank and the return generates EF message 5709 to prevent e-filing. If the taxpayer's W2 displays a taxpayer identification number, you can remove the message and enable e-filing by entering the W2 TIN in the override field at the bottom of screen W2.

Once all message pages are eliminated, the federal tax return can be e-filed.

Note: Many states, but not all, accept returns showing an ITIN on screen 1 and an SSN on a W2.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!