The taxpayer's my529 (formerly Utah Educational Savings Plan - UESP) credit exceeds 5% of the taxpayer's contribution. For each qualified beneficiary, shouldn't the credit be limited to 5% of the contribution?

In this case, you have entered the taxpayer's contribution on UT screen 2, rather than the credit.

The software does not calculate the my529 credit - you must make that calculation and directly enter the credit amount on UT screen 2. See my529 (code 20) for information on how to figure the credit. Utah limits the credit per beneficiary to 5% of the taxpayer's contribution, not to exceed $100 per qualifying beneficiary ($200 for MFJ).

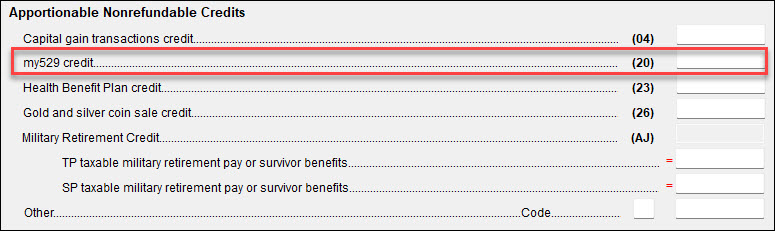

Calculate the my529 credit and enter it on UT screen 2, in the code (20) field under Apportionable Nonrefundable Credit. The my529 credit then appears on the UT Form TC-40A in View/Print mode.

In Drake17 and prior, this is called the Utah Educational Savings Plan (UESP) Credit, and the limits were different. Also, for those years of Drake Tax, if the credit amount entered exceeds the limit per beneficiary, that software limits it and produces a note advising you that the limit was exceeded.

For more information regarding my529 or the older Utah Educational Savings Plan, visit the webpage my529.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!