How can I suppress the printing of RPD-41287 on this New Mexico corporate return?

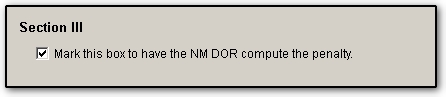

RPD-41287, Calculation of Estimated Corporate Tax – Method 4 Penalty and Interest on Underpayment, is a form produced in the CIT-1, New Mexico Corporate Income and Franchise Tax Return. To suppress the form from printing, go to NM data entry > the Other tab > PEN screen and select Mark this box to have the NM DOR compute the penalty.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!