Drake Accounting®: How do I make corrections to an e-filed 1099 or W-2 / W-3?

Note: It is recommended to print or save a copy of any original documents before making changes. Before printing or saving corrected Forms 1099 and associated 1096, uncheck any vendors that do not need corrections or re-process only the corrected forms.

Only follow these steps if the e-File was accepted by the FIRE site. If the file was rejected/had a "BAD" status, do not use the Corrected checkbox. When an e-File is rejected, the e-File can be submitted again.

To make a corrected Form 1099:

For Vendors:

- Go to Payables > Federal Forms > Select the desired Form 1099 from the Form drop list.

- Select the Vendor that needs to be corrected.

- The 1099 must be processed to allow changes.

- Select the Corrected box, above the Form 1099 and make necessary changes.

.jpg)

- Click Save or Save/Print to finalize the changes.

For On the Fly forms:

- Go to On the Fly > Federal Forms > Forms 1099 (default) > select the desired Form 1099 from the Form Type drop list.

- Select the Vendor that needs to be corrected.

- On the Fly forms do not have a process option.

.jpg)

- Select the Corrected box, above the Form 1099 and make necessary changes.

- Click Save or Save/Print to finalize the changes.

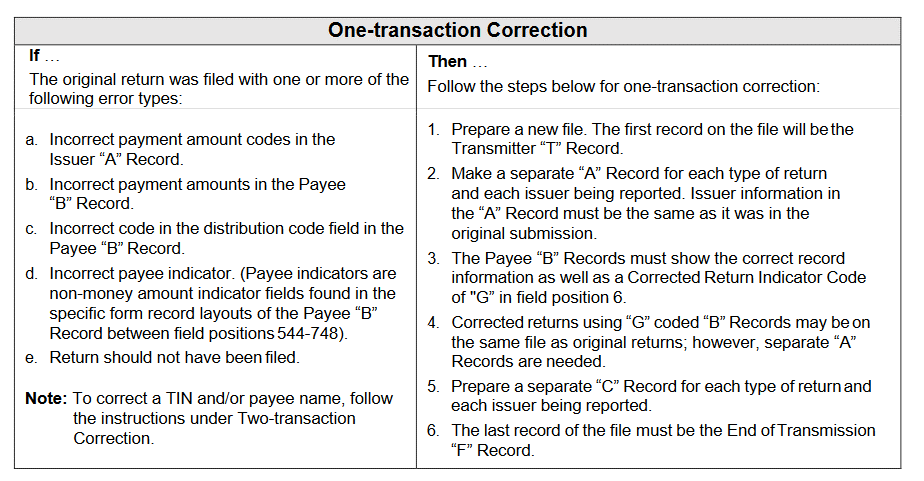

A corrected Form 1099 can only be e-filed through DAS if the correction that was made to the form is considered a one-transaction correction.

See General Instructions for Certain Information Returns for filing requirements.

When e-Filing a corrected 1099, follow the chart below from Publication 1220:

Form W-2c is used to correct Form W2. Form W-2c is not intended to report back pay or to correct Form W-2G, Certain Gambling Winnings.

Form W-3c is required to be filed with Form W-2c and is automatically produced in the background when Forms W-2c are processed.

Note: Drake Accounting® requires a processed W-2/W-3 in order to create a W-2c/W-3c. Forms W-2c/W-3c cannot be e-filed through Drake Accounting® at this time. These forms must be paper-filed.

The steps for creating the W-2c/W-3c are the same for Employees and On the Fly forms.

- Go to Employees > Federal Forms.

- or On the Fly > Federal Forms

- Select Forms W-2c/W-3c from the Form Type drop list and W-2c from the Form drop list..

- Select the employees from the list on the left side of the window that require corrections.

- Click Process.

- Select an employee’s W-2c by either double-clicking the employee or using the Find Employee drop list at the top of the window. You can also page through the processed forms using the page tabs.

- Make necessary changes directly in the appropriate fields.

- Repeat steps 5-6 until all edits have been made and then click Save or Save/Print to save your changes.

You can print forms W-2c or W-3c at this time, or click Save to print them at a later time. To print at a later time, go to Tools > Review Reports and select Display Federal Reports (PDF) from the drop list.

The edited forms W-2c are saved and an updated W-3c is generated. If the Print W-3c check box is selected when you click Save/Print, the W-3c displays in a separate PDF window.

Note: All forms W-2c and W-3c can be printed on plain paper using a laser printer and on red line forms using the data only option.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!