How does the Kansas City Missouri earnings tax, Form RD-109, function starting in Drake19?

Resident individuals owe earnings tax on all salaries, wages, commissions, and other compensation for work done or services performed regardless of the location where the work is done or the services are performed. Nonresident individuals owe earnings tax on all salaries, wages, commissions, and other compensation for work done or services performed or rendered within the city.

Note: The KC 109 will not be generated in view when Kansas City withholdings are 1% of income, unless it is forced to print (from the KC 109 screen) or if the 109N screen has entries for a non-resident.

Residents:

An entry of KC as the Resident City on federal screen 1 indicates that the taxpayer is a full-year resident of Kansas City and owes the earnings tax on all earnings.

Non-resident and Part-Year Residents:

Starting in Drake19, nonresidents will indicate that the W-2 and 1099-M income is subject to the earnings tax by selecting KC as the locality on:

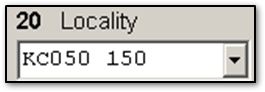

- W2 screen line 20, or

- 99M screen line 18.

When the W2 wages are earned for work both inside and outside the city, Form RD-109NR, Wage Earner Return Earnings Tax Nonresident Schedule, is used to allocate earnings by days worked. Form RD-109N must be completed for each W2 where a nonresident deduction is warranted. The nonresident allocation can be made on screen W2 using the format of the first three numbers as actual days worked inside Kansas City and the second set of numbers as the total days worked all year for this W-2. For example, if the taxpayer worked 50 days inside KC and 150 days total for this W2, enter the Locality as KC050 150:

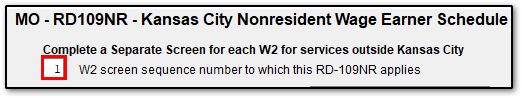

Note: If you decide to enter the allocation in the above manner, ensure that you have made an entry in the MO 109N screen in the box W2 screen sequence number to which this RD-109NR applies. This field functions like a MFC box where the value corresponds to the order in which the W2s are entered on the federal data entry screen. The 109N screen is located on the States > Missouri > Cities tab.

The nonresident allocation can also be entered directly on screen 109N. Since screen 109N will always be used to associate the W2 and to enter employer contact information required for e-file, it may be more convenient to enter all information on screen 109N.

Local Tax Fully Withheld on W2 (special circumstance)

A Kansas City return does not have to be filed when its withholdings sufficiently cover its income. Starting in May 2019, the KC 109, Wage Earner Return, will no longer generate automatically when:

- Kansas City withholdings are sufficient for the income, and

- the return would yield a $0 due on line 9.

The KC 109 will be generated if it is forced to print via the checkbox Force RD-109 to print on the 109 screen, or if the 109N screen has entries for a non-resident filer.

Sufficient Withholding occurs during the following common scenarios:

- Kansas City withholding (W2 box 19) is 1% of Kansas City wages (W2 box 18).

- A Kansas City, MO residents’ W2 reports income to a state other than Kansas City, MO.

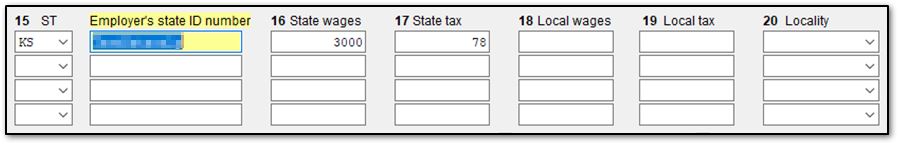

- For instance, the following W2 is sourced completely to the state of Kansas, even though the taxpayer is a Kansas City, MO resident (indicated on federal screen 1):

- As none of this income is taxed to Kansas City, MO (line 18), Kansas City tax, by default, is sufficiently withheld.

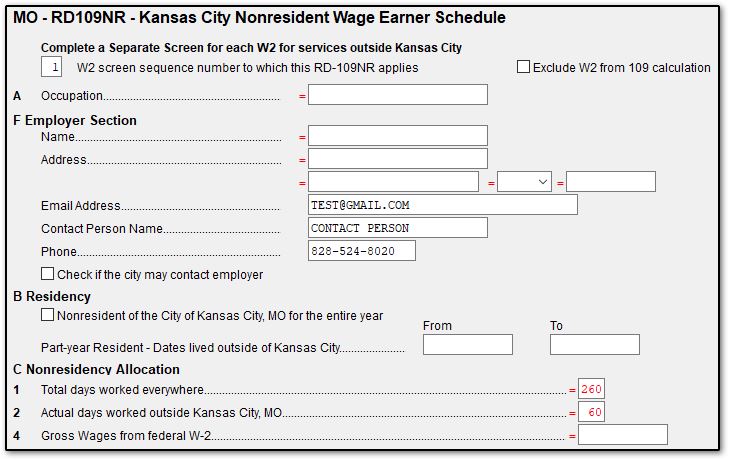

An apparent “sufficiently withheld” return may need to be manually reviewed and adjusted when a Kansas City non-resident works in Kansas City and another municipality. To do this, you must enter the following information on the 109N screen:

- W2 screen sequence number to which this RD-109NR applies - corresponds to the order in which the W2 appears in federal data entry

- F Employer Section:

- Email Address

- Contact Person Name

- Phone

- C Nonresidency Allocation:

- 1 Total days worked everywhere (defaults to 260)

- 2 Actual Days worked outside Kansas City, MO overrides the days worked outside of Kansas City, MO (part C, line 2) carried from the W2.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!