Does Arizona allow for the state standard deduction to be increased by charitable deductions?

Yes, AZ allow a Standard Deduction Increase for Charitable Deductions on Form 140 equal to the amount that would have been allowed for Itemized Deduction purposes on the Federal Schedule A after a subtraction for the amounts listed on Federal Form 1040, line 10B and any amounts that would qualify as a Federal Charitable deduction on the Schedule A.

To arrive at the Increased Standard Deduction amount, include all contributions on the Federal Schedule A screen. Amounts for Forms 321 and 352 should always be listed on the Federal Schedule A as they qualify under the safe harbor rules. Include any additional contributions that the taxpayer may have made that would also qualify for the credits.

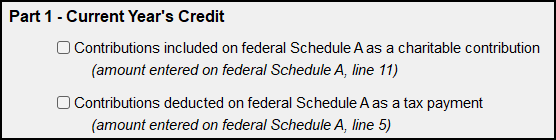

When completing the AZ Credits forms, mark the check box at the top of the AZ screens on the Credits tab to indicate the amounts have been included on the Federal Schedule A.

The amounts will be included on line 1C of the page 3 Standard deduction Increase. Line 6C will total the credits used that have been included in the Federal Schedule A amounts.

Guidance has been received from the AZ DOR as follows:

The charitable contributions claimed under Forms 321 and Form 352 are the type of refundable credits eligible for the safe harbor provision mentioned here. The safe harbor provision really allows two things, charitable deductions that result in state tax credits at or below 15% may be claimed as a charitable contribution. Now if the state tax credit exceeds the 15% threshold it may not be claimed as a charitable contribution for federal purposes, however if the taxpayer is under the $10,000 state and local tax cap (SALT cap) they may elect to treat these charitable contributions as state tax payments and still receive a federal itemized deduction for it. Arizona's credits under Form 321 and 352 are 100% refundable so contributions may only be claimed if as federal itemized deduction if they are taken as a state tax payment on the federal 1040, schedule A.

Line 1C should include all cash contributions to charitable organizations made during the tax year that are allowed on the federal Form 1040 Schedule A (or would have been allowed had the taxpayer itemized deductions for federal purposes) including those cash contributions claimed on Form 321 and 352. Because line 1C includes all cash contributions, the amount entered on 6c includes all charitable tax credits claimed on the Arizona tax return.

Arizona law provides that a taxpayer cannot take a deduction and claim a tax credit for the same charitable contributions. Since the allowable charitable deduction taken on the federal return is reflected in the taxpayers FAGI which flows through to Arizona Gross Income, the taxpayer must reduce the available amount of charitable contributions (used to compute the standard deduction increase) by the total amount of charitable tax credits claimed on the Arizona tax return before computing the allowable increase.

Note: Line 6c should reflect the amount of all Arizona tax credits claimed for contributions made to charitable organizations (Forms 321, 323, 348 and 352). The amount is not limited to amounts claimed on Forms 321 and 352. This clarification will be made on the 2021 tax forms.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!