How do I create and e-file an amended return within Drake Zero?

To amend a federal return, do the following:

- Open the return you want to amend. Do NOT make any changes before completing steps 2-5 for the federal return.

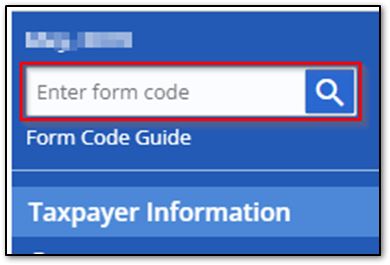

- Enter X in the Form Code Box located at the top left of the screen, then click the magnifying glass. This will open the Form 1040X – Amended Return screen.

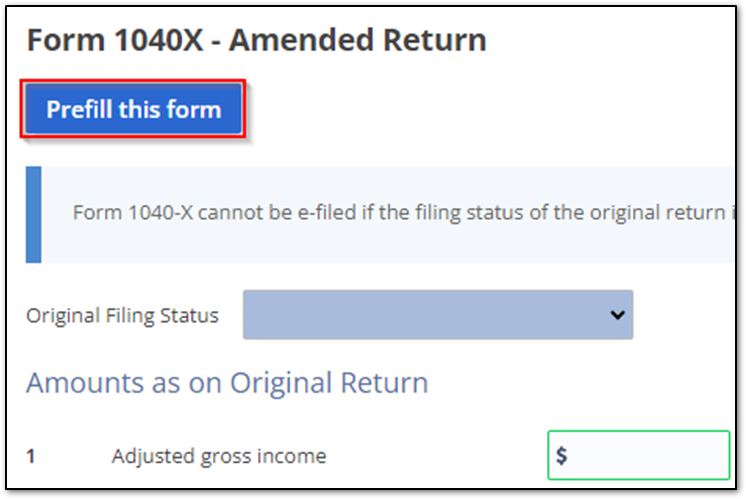

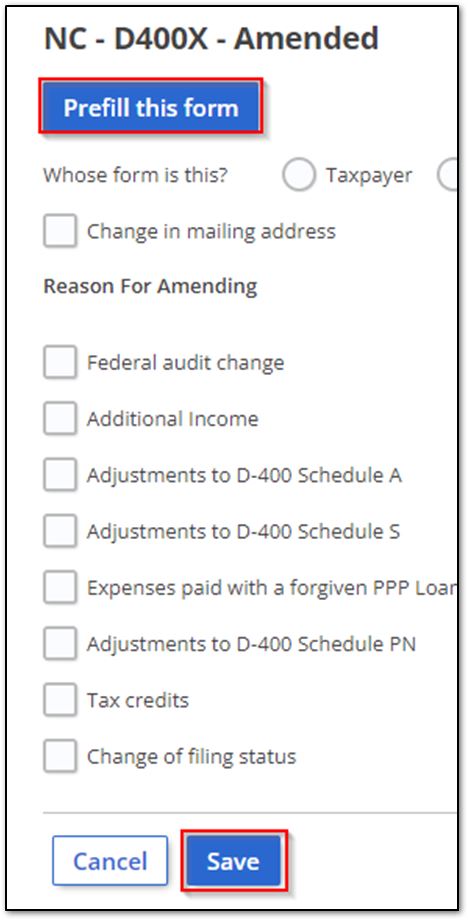

- If the original return was created within Drake Zero, you can press Prefill this form to automatically bring in the amounts from the original return. If you did not create the return within Drake Zero, you can use the fields outlined in green to enter the amounts on the original form.

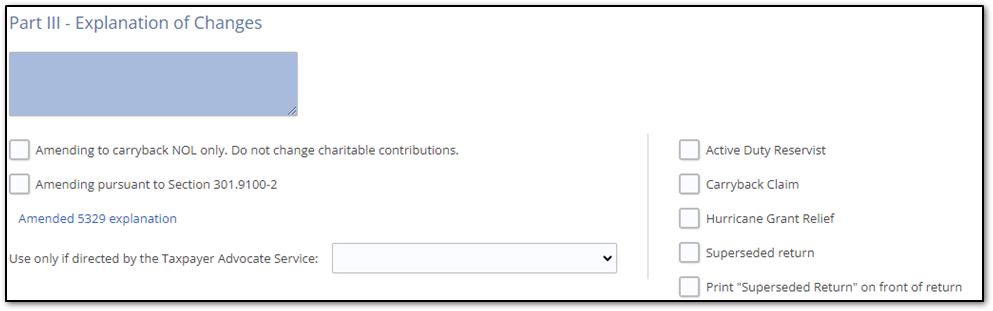

- Enter your explanation of changes at the bottom.

- Press Save at the bottom left of the screen for Form 1040X.

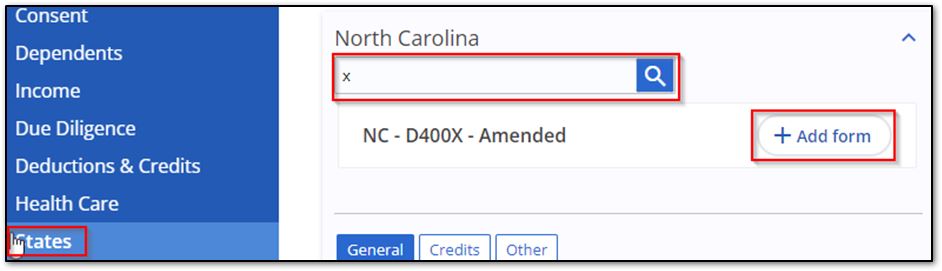

- To include a state amended return, do the following:

- Click States at the left

- Select state from the drop list, and search X to bring up a list of forms.

- Click Add Form to the right of the desired form to open the state amended form screen.

- Fill out the amended state screen by either pre-filling the form or entering the information directly.

- Click Save to finish the state amended form; this will also bring you back to the Form 1040X screen.

- Make your changes to the return.

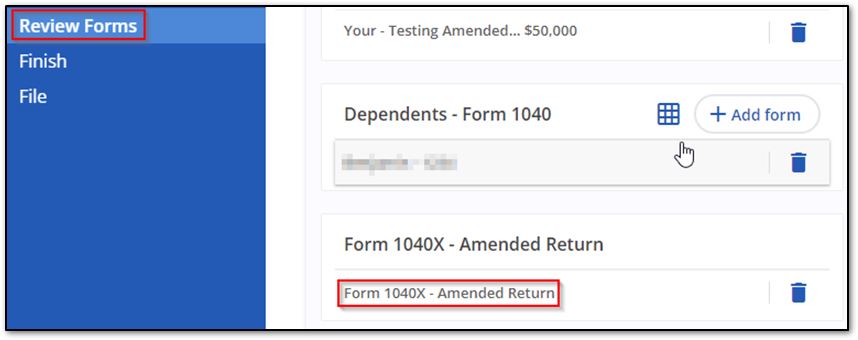

- Confirm the Form 1040X and state amended forms are on your list of forms by clicking Review Forms.

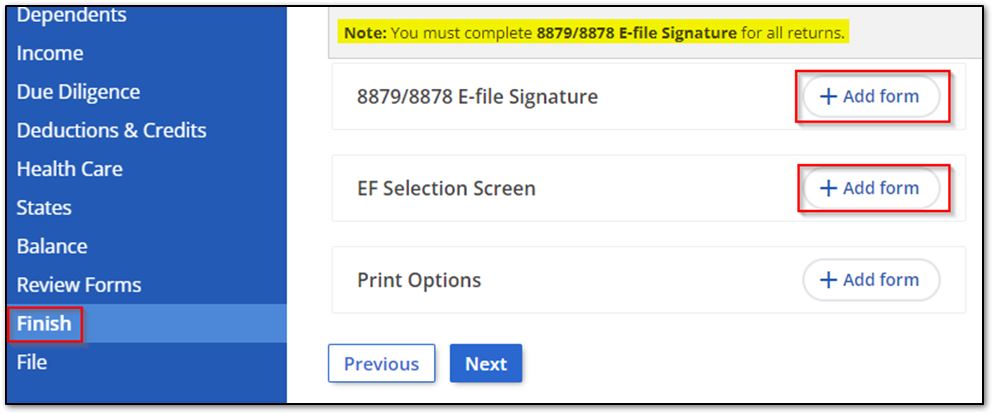

- Once ready to e-file the return, click Finish on the left. Do the following:

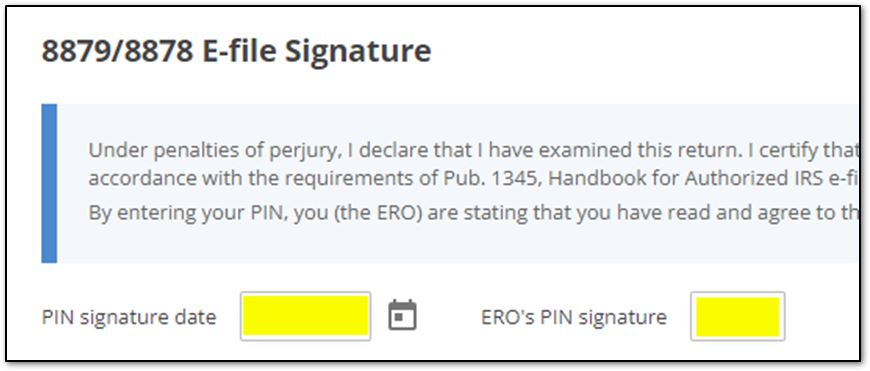

- Click Add form next to 8879/8878 to apply your e-file signature.

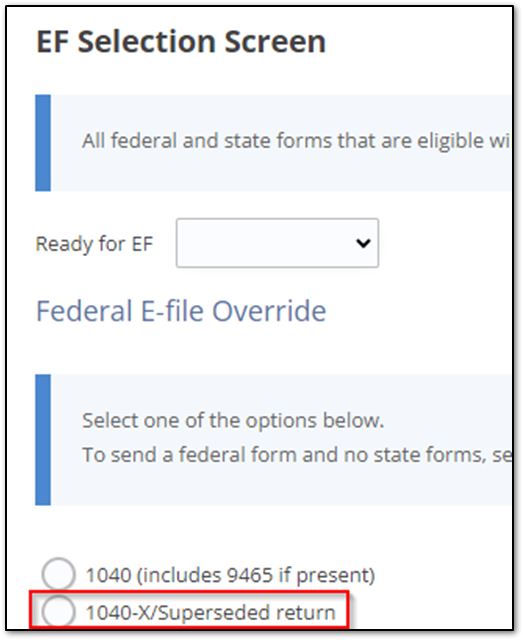

- Click Add form next to EF Selection Screen to select the Form 1040X and any state amended forms you want to e-file.

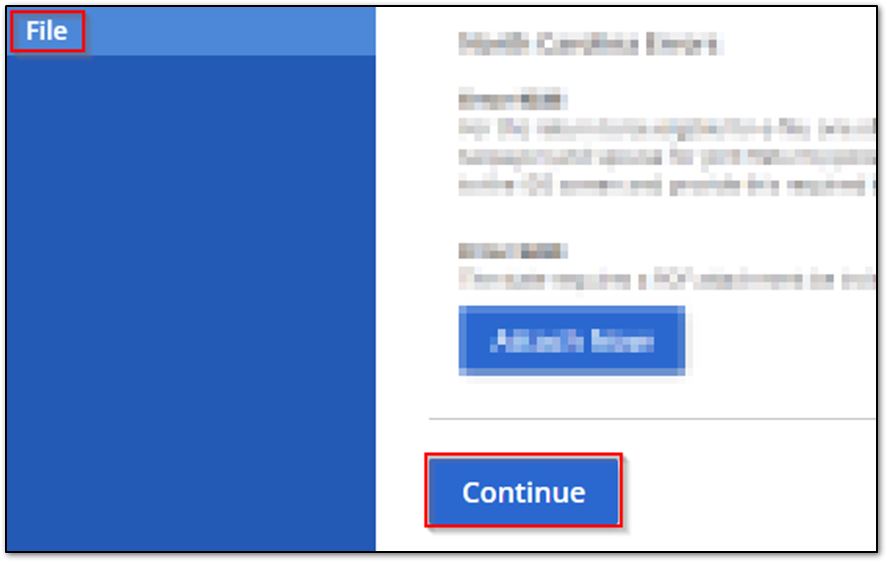

- Click File on the left to review end amounts and see any federal and/or state messages you may need to correct before you can e-file. If there are no errors, click Continue at the lower left.

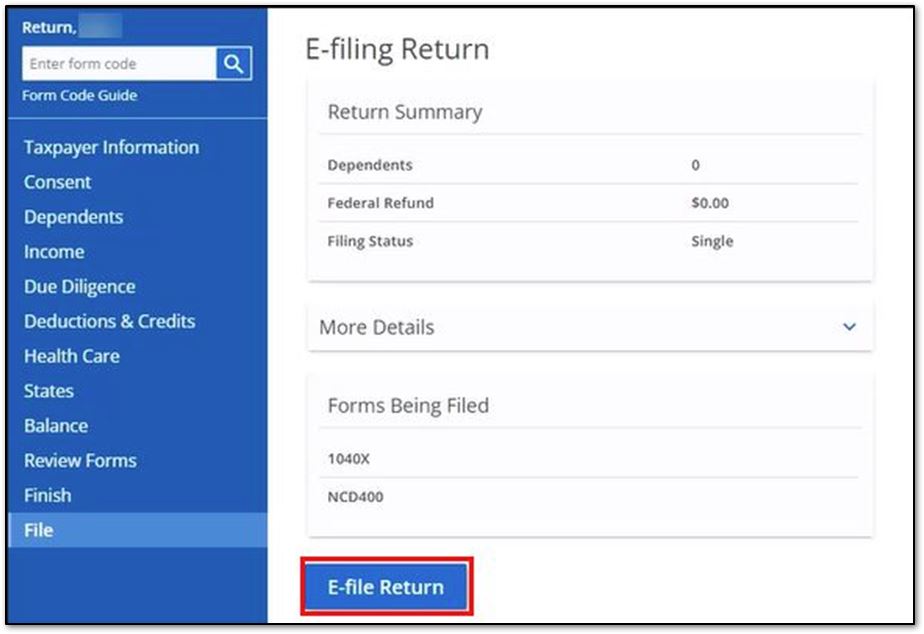

- Review details for accuracy one final time, then click E-file Return.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!