What is the difference between the Single and Multi-User versions of Drake Tax?

For tax year 2024, customers will have a new product to choose when purchasing Drake Tax Pro or Drake Tax 1040: Single User or Multi-User. The version you choose depends on the number of Users in your firm.

Click here for a video overview of Single User vs. Multi-User.

Who is considered a "User"?

For Drake Tax purposes, a User is a Tax Preparer

who, per IRS guidelines, must have a PTIN. Per the IRS, anyone who

prepares or assists in preparing federal tax returns for compensation

must have a valid PTIN before preparing returns. Users (Tax Preparers) are considered any of the following:

- A signing tax preparer

- A nonsigning tax preparer

- A supervised registered tax preparer

What about my staff members who are not tax preparers?

Support Staff are not tax return preparers; anyone who is not required to have a PTIN is not counted as a User. This includes staff members who perform tasks such as data entry, scheduling, reporting, client services, intake, and managing client information. Examples of Support Staff include:

- A data entry clerk, who enters data into the software while being employed

- An office assistant who

performs tasks in the software related to workflow, customer intake and

scheduling, reporting, and customer service

Which version is right for me?

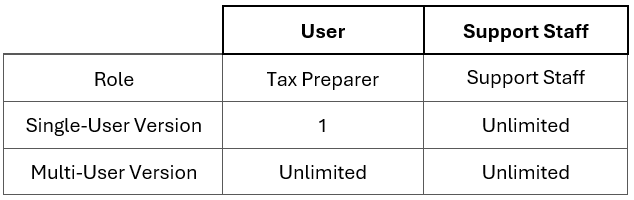

Each tax return preparer in your firm with a PTIN is counted as a User. The Single-User version is for businesses with one tax return preparer (PTIN holder) only and is limited to one User. Firms with multiple tax return preparers (Users) should purchase the Multi-User version.

- If you have one tax preparer in your firm, choose the Single-User version of Drake Tax, which allows for one User.

- If you have two or more tax preparers in your firm, choose the Multi-User version, which allows for an unlimited number of Users.

Both versions allow for an unlimited number of Support Staff.

Examples

The following examples illustrate single-user and multi-user scenarios.

Example A

Jane owns Jane’s Tax Service and prepares returns for individuals and businesses. Jane has a PTIN and signs the returns. Jane’s husband, Tom, works in the office and helps Jane with day-to-day operations. Tom schedules appointments, updates client information in Drake Tax as needed, assists clients with preparing for appointments, and maintains software and computer updates.

Jane is a tax preparer, and therefore a User in Drake Tax. Tom performs many office tasks but does not prepare or assist in preparing tax returns and does not have a PTIN. Tom is not a tax return preparer.

Since Jane’s Tax Service has one tax preparer, Jane should purchase the Single-User version of Drake Tax.

Example B

Bill and Sue Finley own and operate Finley’s Tax Service. Sue prepares tax returns for their clients. Bill primarily performs bookkeeping services for their business clients, but he substantially aids Sue in preparing tax returns. They both have PTINs, but Sue typically signs all tax returns.

Their daughter, Annie, works in the office in an administrative role—serving as a receptionist, answering phone calls, scheduling, and occasionally entering or updating client information in Drake Tax. Annie does not prepare or assist in preparing tax returns and therefore does not have a PTIN.

While Bill’s main focus is not tax preparation, he does provide a substantial amount of assistance in preparing tax returns and is therefore required by the IRS to have PTIN. Sue and Bill are both tax preparers and would be considered Users in Drake Tax; Annie is not a tax preparer.

Since there is more than one User at Finley’s Tax Service, the firm would need to purchase the Multi-User version of Drake Tax.

FAQs

Can I enter two tax preparers and their PTINs in the Single-User version?

No, the Single-User version allows you to set up one User only—meaning one tax return preparer and their PTIN. If your firm has more than one tax preparer, choose the Multi-User version, which allows for unlimited tax preparers (PTIN holders).

What is the difference between a data entry clerk, supervised preparer, and a nonsigning tax preparer?

- Data entry clerk: A tax preparer, as defined by the Internal Revenue Code, is any individual who prepares a tax return for compensation, including a CPA or an enrolled agent. A person who enters tax information while being employed, such as a data entry clerk, is not considered a tax preparer and does not need a PTIN, as they are not recommending or advising on tax positions, interpreting the Code, or reviewing returns for accuracy—they are simply entering information.

- Supervised Registered Tax Preparer (SRTP): An individual who does not, and is not required to, sign a tax return as paid preparer; works at a firm at least 80% owned by CPAs, attorneys, or enrolled agents, and is supervised by a CPA, attorney, or enrolled agent; and has a PTIN. They are a tax preparer.

- Nonsigning Preparers: Any tax return preparer who is not a signing tax return preparer but who prepares all or a substantial portion of a return or claim for refund with respect to events that have occurred at the time the advice is provided. This includes a person who provides advice (written or oral) about events that have occurred that leads to a position on a return (or claim for refund), and that position constitutes a substantial portion of the return. They are a tax preparer.

How many users can I have with Drake Tax PPR?

Drake Tax PPR uses the Multi-User version by default; you can have as many users as needed.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!