How do I purchase and redeem a return as a Pay Per Return (PPR) user?

Preparers must be connected to the Internet to purchase and redeem PPR returns. The number of returns purchased and the number of returns redeemed will still be recorded on your computer. An internet connection is required if the software was ever in PPR mode.

Pay Per Return Summary

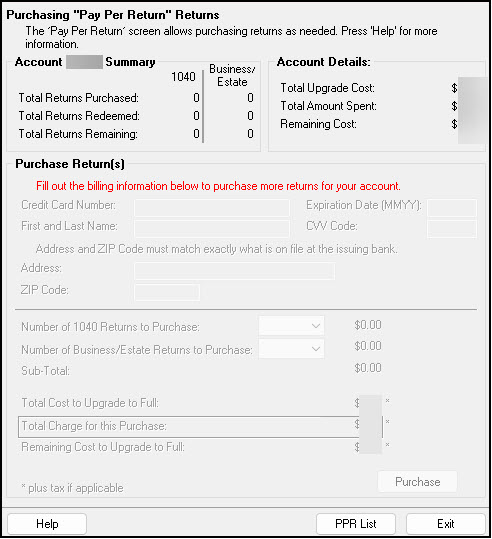

Open Drake Software and go to the Setup > Pay Per Return screen:

- Account Summary - broken down in the following categories, cross-referenced with whether the return is an Individual (1040, 1040-NR, 1040-SS Returns) or a Business/Estate (1120, 1120-S, 1120-H, 1065, 1041, 990, 706 Returns).

- Total Returns Purchased

- Shows how many returns have been purchased. The PPR package comes with:

- Ten (10) Individual (1040) returns

- Zero (0) Business/Estate returns.

- Total Returns Redeemed

- A return is “redeemed” when you:

- Start a new return,

- Update an existing return*

- Change the SSN or EIN on a return,

- Use the Quick Estimator.

- Note: A return redeemed on this machine can be moved to another machine.

- Total Returns Remaining

- The total returns remaining are the amount of returns that have been purchased, but have not been redeemed.

- Account Details - This section allows you to see how much it would cost to upgrade your PPR package to Pro.

- Purchase Returns - This section allows you to purchase additional returns (see below for details).

- PPR List - Verify which ID numbers were used to activate returns.

Purchasing Returns

To successfully complete a PPR purchase, you must have:

- an active Drake account

- the correct account information entered on the ERO screen

- an internet connection

To purchase:

- Go to Setup > Pay Per Return.

- Enter valid credit card and billing information.

- Select the number of 1040 and/or Business/Estate Returns to purchase.

- Verify the transaction details and click Purchase.

- Respond to the prompts to confirm the purchased. A successful purchase confirmation is returned within a few seconds after the purchase has been completed.

Notes:

- If the EFIN information on the ERO screen is missing or did not pass the validation process, you are prompted to correct it.

- If the credit card purchase cannot be completed for any reason, the error message for the invalid field is given. For example: "missing name or address field," or an invalid expiration date message if the credit card has expired.

- If the credit card number is incomplete or does not meet the standards for the accepted credit cards, an error message is displayed.

- Once returns are paid for, they can be used or "redeemed" simply creating and redeeming a new return or updating a return from the previous year.

- Returns can be redeemed only one at a time.

- Returns cannot be purchased or redeemed by phone. If your internet connection is offline, you can still work in redeemed returns, but you cannot purchase or redeem more returns until the internet connection is reestablished.

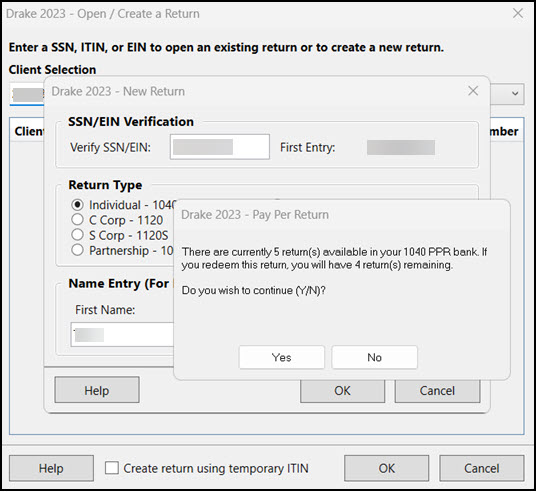

PPR Banks (1040 and Business/Estate)

When you have available returns during the Open/Create process, you will see the notification that the redemption will decrease the available number of returns in the 1040 PPR bank or Business/Estate Bank and show how many will remain after that return is redeemed:

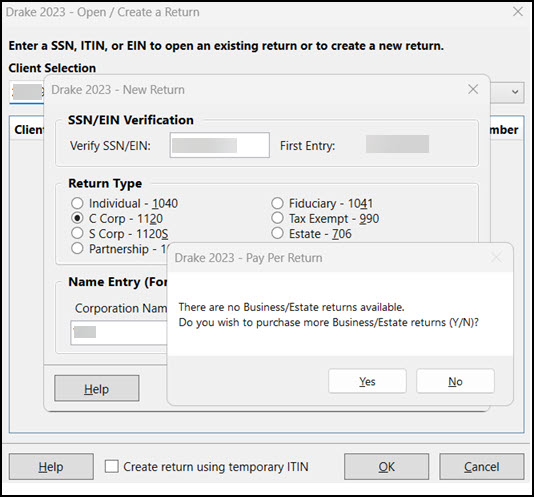

It is important to note that Zero (0) business/estate returns are included with your initial PPR purchase. You must purchase a business/estate return before you will be able to redeem and create any business or estate returns. If you attempt to redeem a return when there are no available (unredeemed) returns for that type, you will see the message "There are no Business/Estate returns available. Do you wish to purchase more Business/Estate returns (Y/N)?"

This message will appear if you do not have any returns available for the return type indicated. For example, even if you have not redeemed all of your 1040 returns, but are trying to create a business/estate return, this message will display. You must have an available return of that type (1040 or business/estate) before you can continue.

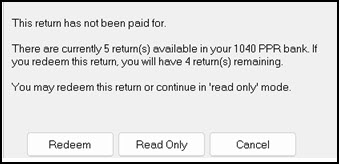

Updating Returns and Redeeming vs. Read Only

It is recommended that you update returns as you begin to work on them. If you choose to update a return, it will not be redeemed until you choose to open it in data entry. The following pop-up will ask if you want to redeem the return or continue in read-only mode:

There are several ways to use PPRs so that they are counted against your total of purchased and redeemed returns:

- Starting a new return

- Updating an existing return

- Changing the SSN or EIN of a return

- Changing the file type

- Using the Quick Estimator (to start a return)

Starting a new return:

- From the Home window toolbar, click Open/Create.

- Enter an SSN or EIN in the Open/Create a New Return dialog box. Click OK.

- In the Open Return window, click Yes.

- Verify the SSN/EIN.

- Select a Return Type.

- Enter a name in the Name Entry text box. Click OK.

- Click Yes to verify that you want this return counted against your total of PPRs.

Updating a return:

- From the Home window, go to Last Year Data > Update Clients 20XX to 20YY.

- In the Update Client Selection dialog box, enter an SSN/EIN and click Add Client.

- Click Next.

- In the Update Options menu, select the items to update.

- Click the Update 1040 button. (If you are updating business* returns, the button will be labeled with the appropriate return type - 1120, 1120s, 1065, etc.)

- You are offered the opportunity to count the newly updated return against your supply of purchased but unredeemed returns, or to open the return in read-only mode. You cannot make any new entries or calculate the return while in read-only mode.

Another method of updating a return is to click Open/Create from the toolbar, enter the SSN or EIN of a previous year’s client, and then make selections from the Update Options menu. You are then given the option to redeem the return, open in read only, or cancel.

Changing the SSN or EIN of a return:

When the SSN or EIN is displayed on screen 1 of data entry, the return is counted against your supply of returns. You can change the SSN or EIN associated with a return, but this will cost you another PPR. To change it:

- From the Home window, go to Tools > File Maintenance > Change SSN/EIN on Return. An alert reminds you that changing the SSN counts against your total number of PPRs. Click Yes.

- In the Incorrect SSN/EIN text box, enter the current SSN/EIN.

- In the Correct SSN/EIN text box, enter the new SSN/EIN to associate with this return.

- Click Continue, and then click Exit.

- After changing a return’s SSN or EIN, update your client list by running the Repair Index Files tool. From the Home window, go to Tools > Repair Index Files

Changing File Type:

You can change the file type of a return (1040, 1120S, etc.), but this will cost you

another PPR*.

To change the file type:

- From the Home window, go to Tools > File Maintenance > Change

File Type to open the Convert Client Data File Type dialog box. An

alert reminds you that changing the SSN counts against your total of PPRs.

- Click Yes.

- Enter the SSN/EIN of the return you wish to change.

- Click Continue.

- From the Convert this file to: section, select the type of return you wish

this return to be converted to.

- Click Continue, and then click OK.

Using the Quick Estimator (to start a return):

The Quick Estimator is used to quickly calculate results for an individual (1040) return. Please note:

- In PPR mode, each use of the Quick Estimator starts a new return and counts against your total of purchased and unredeemed PPRs.

- In PPR mode, use of the Quick Estimator with already started returns does not count against your total.

- The Quick Estimator produces only one return if Married Filing Separately is selected as the filing status. A separate return must be generated (using another PPR) for the spouse.

Important: Do not file the return generated in the Quick Estimator with the

IRS or an amended return will be required.

*Business return creation and conversion is only available if you have purchased a business return PPR (Drake22 and future).

Upgraded to Pro

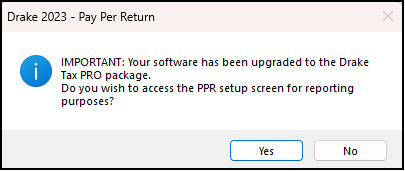

If you have upgraded your purchase to Drake Tax Pro from PPR, you will see this message when you go to Setup > Pay Per Return. You can click Yes to access the setup screen for reporting purposes:

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!