Where can I enter the PY residency dates for Maryland? How can I clear MD EF Message 0138?

Part Year residency dates:

If you have selected PY as the Resident State on federal screen 1, you must enter the dates of residency on the state screen as well.

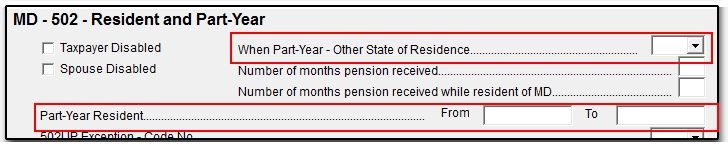

In data entry of the return, select MD from the States tab. Select screen 1- 502 Resident and Part-Year from the MD menu.

Indicate the other state of residence, and enter dates of PY residency as shown below.

MD EF Message 0138 states:

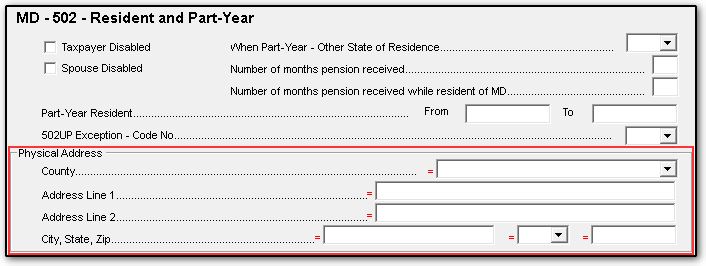

MD502 Physical Address

Maryland Address at which you resided on the last day of the taxable period must be present.

This message occurs anytime the mailing address entered on federal screen 1 is NOT a Maryland mailing address. For part-year filers that moved out of Maryland during the tax year, or Maryland residents that have their mail delivered to a different state or country, go to the States tab > select Maryland > screen 1 - 502 Resident and Part Year > Physical Address section.

For Maryland residents with mailing addresses in a different state/country, enter the address of your home in Maryland.

For Part-Year residents that moved out of Maryland during the year, enter the address where you resided while you were a resident of Maryland.

See the Maryland 502 instructions for more information.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!