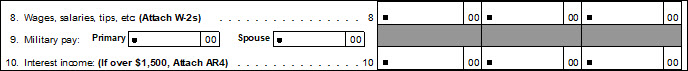

In an AR1000F or AR1000NR, how do I enter military compensation in columns A, B, or C of line 9?

All of the service pay or allowance received by an active duty member of the armed services is exempt from Arkansas income tax. The exemption is no longer limited to $9,000.

Consequently, there is no military income to be entered in column A, B, or C on line 9. Those three fields are disabled accordingly.

U.S. Military compensation includes wages received by members of the Army, Navy, Air Force, Marine Corps, Coast Guard, National Guard, and Reserve Units.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!