Drake Accounting®: How do I enter transactions for a bank reconciliation?

A bank reconciliation compares the account balance of a current asset account against the bank balance for that account. The journal does not have to be posted to the Chart of Accounts prior to running a bank reconciliation. Once a bank reconciliation using a given Account and Statement Date has been finished, that same Account and Statement Date combination cannot be reconciled again.

Bank Reconciliation only pulls transactions back 13 months from the Statement Date. For a full and complete Bank Reconciliation, both sides must balance.

- To load transactions, go to Accounting > Bank Reconciliation.

- In the Account field, select an account from the drop list.

- Only postable Current Asset and Current Liability with a sub-type of credit card accounts from the Chart of Accounts are listed.

- In the Statement Date field, enter the last date to be included in the bank reconciliation.

- Enter the Starting Balance, which is the previous month’s Ending Balance.

- Enter the Ending Balance.

- Click Load Trans.

- All of the transactions that were entered in the journal will populate under Book Report (on the left).

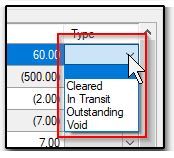

- To clear a transaction, select Cleared in the Type column.

- If the transaction is still in transit, select In Transit.

- If the transaction is outstanding or void, make the appropriate selection.

- If you want to add transactions, click Journal Entry on the far right.

- Use manual journal entries to enter bank-initiated items such as interest and penalties or to make corrections. All manual entries to the journal must have an offsetting entry.

- Once the reconciliation process is complete, click Finish.

See the video Bank Reconciliation for a demonstration of this process.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!