Does Drake Tax automatically calculate the gain that results from a distribution in excess of basis from a S-corporation K1 reported on the 1040 return?

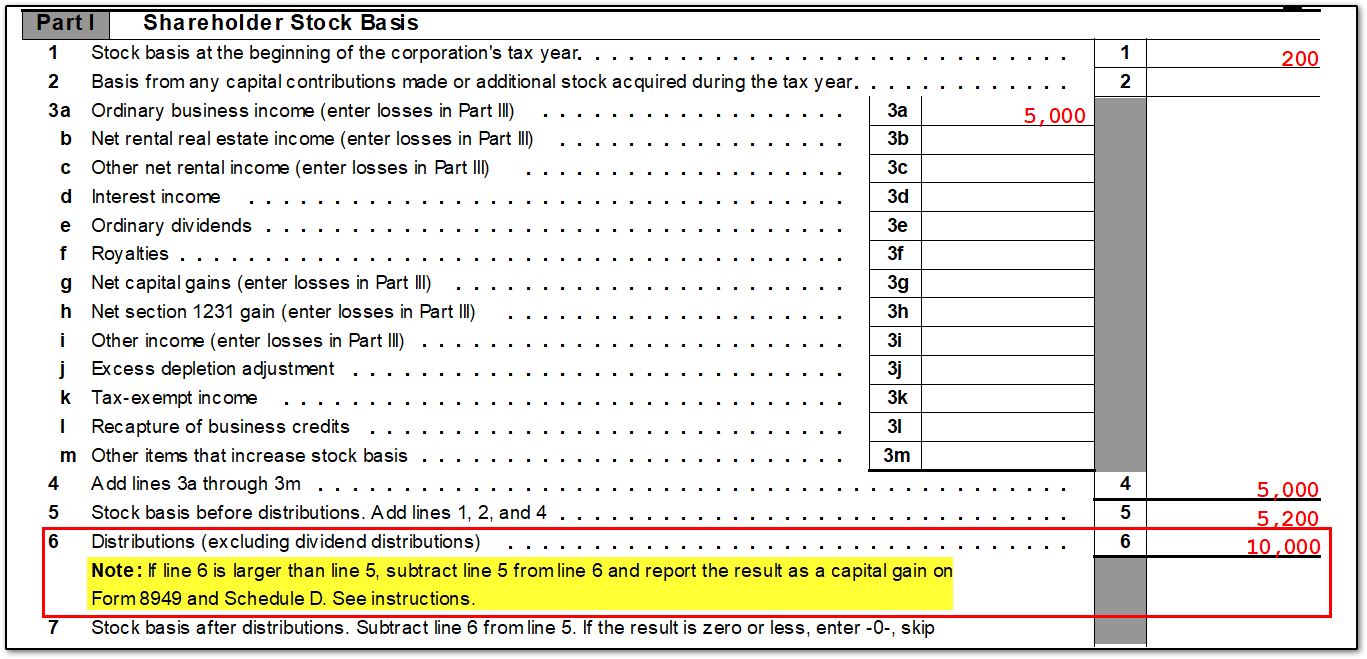

A distribution reported in box 16, code D flows to Form 7203, line 6. If the amount is greater than line 5, the difference is reported on Form 8949 and Schedule D.

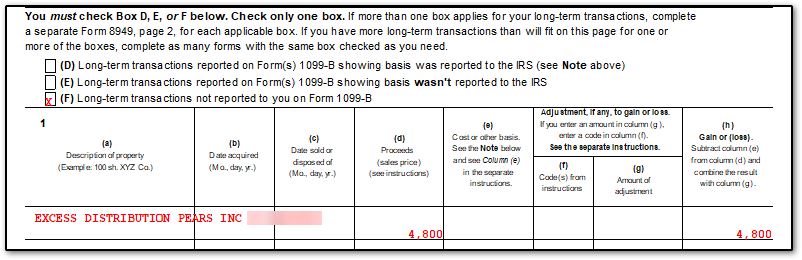

Review Form 8949, Part II. Box F is checked and the description shows as "Excess Distribution" with the name and EIN of the S corporation listed:

Note: Distributions in excess of stock basis are treated as capital gains regardless of whether or not the taxpayer has debt basis.

See the IRS' page S-Corporation Stock and Debt Basis for more information about basis and distributions.

Form 7203 replaced the basis worksheets for S-Corporations starting in Drake21. In Drake20 and prior, see the basis worksheets for calculation details instead.

In prior years, the gain is not automatically computed (see note 216). Manual entries on screen D and the basis worksheet screen were required.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!