Drake Accounting®: How do I use the Adjust Box 14 Entries feature?

In Drake Accounting® 2020, there is an option called Adjust Box 14 Entries for box 14 when completing Forms W-2 under the Employees module or under the On the Fly module. This is located in the bottom left corner when completing the form. This option allows you to enter multiple box 14 codes at once and assign amounts to each one without having to double-click on each W-2 individually. In DAS21 and future, the option is called Adjust State/Locality Entries and has additional features.

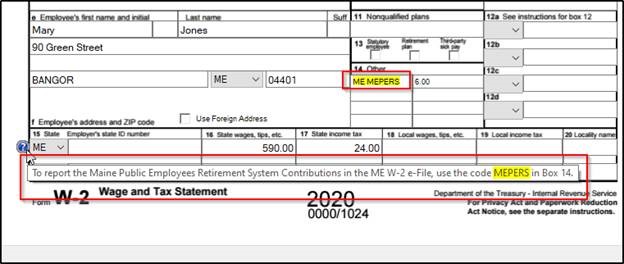

A blue validator will appear when certain states are selected in box 15 and when deductions are applied to box 14 that have certain keywords. The blue validator will display next to the state on box 15 to tell you the specific box 14 code that needs to be used. This is to ensure the state W-2 e-file has the correct code for box 14, as certain states require certain codes.

Note: The following states do not currently file the W-2: AK, CA, FL, NV, NH, SD, TN, TX, WA, and WY.

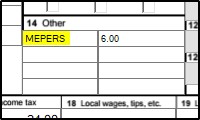

For example, in the screenshot below, box 14 currently shows “ME MEPERS” when the state e-file requires the code “MEPERS” to be used instead, based on the blue validator.

Although this can be changed by manually changing the code in box 14 yourself, it is recommended to use the Adjust Box 14 Entries option because it will ensure you are using the correct box 14 code for the e-file.

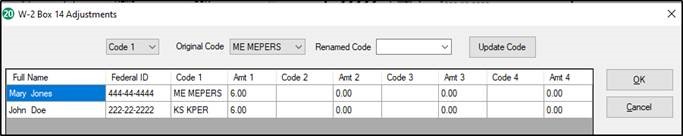

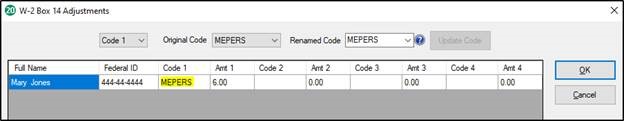

To change the code in box 14 using the Adjust Box 14 Entries option (based on the example above):

- Click the Adjust Box 14 Entries button.

- Ensure you have selected the appropriate person under the Full Name column.

- Select the appropriate code in the first drop down on the left (above the Federal ID column).

- In the previous example, since there is only one code for Mary’s W-2, you would select Code 1.

- However, if there were two codes in box 14 and you wanted to make a change to the second code, you would select Code 2 in the drop down and so on.

- The Original Code drop down contains the name of the code that is currently used for box 14.

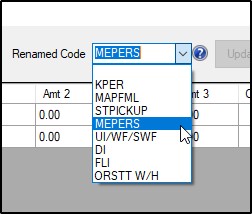

- In the Renamed Code drop down, select the code you wish to apply to box 14 based on the blue validator’s instructions. In this example, you would select “MEPERS” for the code.

- Click Update Code and it will change the code in the grid to the new code (and will also change the code in the Original Code drop down because that is now the current code for box 14).

- You can also change the box 14 code by typing into the Code 1 field.

- The only fields that cannot be changed on the W-2 Box 14 Adjustments window are the Full Name and Federal ID fields.

- Click OK.

- The W-2 will refresh with the new code in Box 14.

States that Require Certain Codes for Box 14:

| Kansas |

KPER

|

Kansas Public Employees’ Retirement System

Individuals affected are state employees, teachers, school district employees and other regular and special members of KPERS, regular and special members of the Kansas Police and Firemen’s Retirement System and members of the Justice and Judge Retirement System.

|

Kansas Public Employees Retirement System |

| Maine |

MEPERS* |

Maine Public Employees Retirement System Contributions

*If you intend to e-file, use MEPERS for the code. If you plan on paper filing, you can choose to use a different code.

|

|

| Maryland |

STPICKUP |

Maryland's State Pickup

For contributions to any mandatory state retirement system.

|

MD W-2 Need-To-Know |

| Massachusetts |

MAPFML |

Employee contribution for Paid Family and Medical Leave |

MA Family and Medical Leave

|

| Oregon |

ORSTT W/H |

Oregon Statewide Transit Tax Withheld |

Oregon Statewide Transit

|

| New Jersey |

UI/WF/SWF

|

New Jersey Unemployment

Insurance/Workforce

Development/Supplemental Workforce Funds

|

New Jersey does not accept paper filings by mail.

New Jersey Electronic Filing Mandate

|

| DI |

New Jersey Disability Insurance |

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!