Can the OR - SP Multnomah/Portland Combined Tax Return be e-filed?

The OR Form SP Combined Tax Return will be available for e-file starting in Drake21. A separate OR INSTR page is produced in view mode of the return that provides further information about the SP Combined Tax Return.

Note: The following Portland, OR forms can be filed once Portland issues the Final versions:

- SP-2023 Combined Tax Return For Individuals

- C-2023 Combined Tax Return For Corporations

- SC-2023 Combined Tax Return For S Corporations

- P-2023 Combined Tax Return For Partnerships

- E-2023 Combined Tax Return For Trusts and Estates

- CES Clean Energy Surcharge

- EXT Request for Extension of Time to File (paper-file only form needed for making a payment)

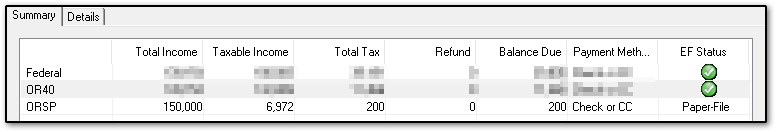

In prior years, OR Form SP was required to be paper-filed to the Revenue Division. When the return is calculated, the ORSP EF Status will be listed as Paper-File, as seen below:

Mail the completed tax return (with supporting tax pages and payment, if applicable) to:

Revenue Division

111 SW Columbia St. Suite 600

Portland, OR 97201-5840

See the SP Instructions for further information. Fillable forms are available here as needed.

Other OR return type eligibility is as follows:

- OR P (1065 OR Portland/Multnomah) can be e-filed starting in Drake21.

- OR SC (1120S OR Portland/Multnomah) can be e-filed starting in Drake21.

- OR C (1120 OR Portland/Multnomah) is still required to be paper-filed in Drake21 and prior.

- OR E (1041 OR Portland/Multnomah) is still required to be paper-filed in Drake21 and prior.

Note: If there is a flagged field on the federal MISC screen, a return may be prevented from e-filing even when otherwise available for e-file. Be sure to clear all flagged fields.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!