Drake Accounting®: How do I create and file the NYS-45?

For filing to the New York Department of Taxation and Finance, DAS produces:

- A .txt file for upload

- A PDF of Form NYS-45, Quarterly Combined Withholding, Wage Reporting, And Unemployment Insurance Return, for record keeping purposes only.

Setup

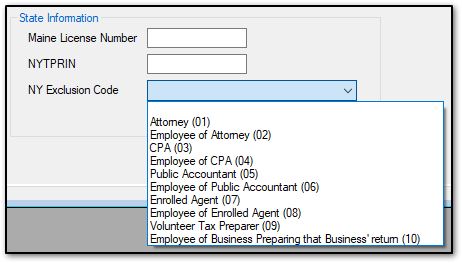

The NYS-45 requires either a preparer NYTPRIN or a valid exclusion code to be entered under Firm > User Setup > Preparer Options tab > State Information section.

Exclusion codes are as follows:

|

Exclusion Code

|

Exemption type

|

|

01

|

Attorney

|

|

02

|

Employee of attorney

|

|

03

|

CPA

|

|

04

|

Employee of CPA

|

|

05

|

PA (Public Accountant)

|

|

06

|

Employee of PA

|

|

07

|

Enrolled agent

|

|

08

|

Employee of enrolled agent

|

|

09

|

Volunteer tax preparer

|

|

10

|

Employee of business preparing that business’ return

|

See Related Links below for other setup items that may be required before creating a state wage report.

To create the wage report:

- Select the Employees or On the Fly menu, then select State Tax & Wage Forms.

- Make sure NY is selected, then select S-45ATT1 from the Forms drop-list.

- Select the applicable quarter.

- Review the form and make any necessary entries or edits.

- Select the appropriate preparer in the Preparer's firm name (or yours, if self-employed) drop down. If needed, the exclusion code can be changed here (see above for global setup).

- Make sure the e-file checkbox is marked, then select Save/Print.

.jpg)

Save/Print creates the watermarked PDF of the Form NYS-45 for record keeping purposes, as well as the .txt file to upload to the state of New York.

To upload:

- Log in to the New York Online Services for tax professionals website.

- Follow the menu options to upload the wage file.

- The file for upload can be found by browsing to the drive where DAS is installed > DrakeAccounting20YY > DAS20YYData (beginning in DAS2021) > Clients > client code > EFile > NY > NYS45ATT1 and selecting the file named NYS45ATT1_YYYY-MM-DD_HR_MIN_SEC.txt (where YYYY-MM-DD_HR_MIN_SEC is the date and time of the file creation).

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!