I updated a 1040 return from 20XX to 20YY and amounts are showing on the ES screen, but the taxpayer did not pay estimated taxes last year. Why are these amounts being updated?

When estimated tax vouchers are produced in the prior year, the amounts are updated to the next year in the 20YY Estimated Taxes Already Paid for This Year section. Beginning in Drake15, estimated payment vouchers are automatically produced when required (see Related Links below). This means that in 2015, if estimated payments were required for the taxpayer(s), estimates were produced in view and Return Note 483 generated:

PAYMENT VOUCHERS GENERATED: The program has automatically produced federal estimated payment vouchers for this return because the taxpayer's taxes due are more than $1,000 greater than the taxpayer's withholdings. The amount of the payments can be adjusted on the ES screen.To suppress the automatic generation of ES payment vouchers, from the Home window, go to Setup > Options > Forms & Schedule Options tab.

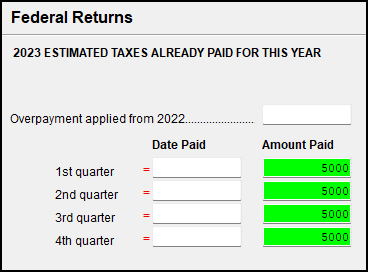

When updating the return to 20YY, the amounts included on the estimated vouchers in 20XX are updated and flagged for review:

The software assumes that when estimated vouchers are required and produced, that the amounts were paid. If the estimates were not paid, or different amounts were actually paid by the taxpayer(s), remove or change the flagged amounts on the updated ES screen.

Note that:

- There is a global setup option at Setup > Options > Form and Schedule Options > Print ES vouchers only when screen ES indicates that prevents the software from automatically generating estimated vouchers.

- If this option was selected in Drake15, ES vouchers were only generated when entries were made on the ES screen to produce vouchers (by a selection from the ES Code drop list or an amount entered in the Estimate amt column).

- All amounts printed on vouchers last year will be updated to the ES screen in the current year of Drake, regardless of the selection at Setup > Options in the previous year of Drake.

On a scale of 1-5, please rate the helpfulness of this article

Optionally provide private feedback to help us improve this article...

Thank you for your feedback!